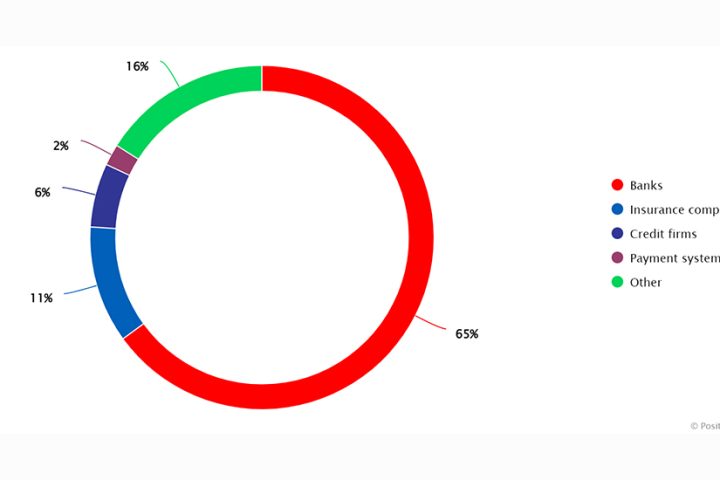

GCC Financial Technology (FinTech) startups are cashing in on the always-connected banking habits of Millennials, industry experts announced today in the build-up to GITEX 2016.

There is a surge in growth of “moneyhawks” – the high-income, and under-35-year-old customers who want constant mobile access to their banking and finance accounts.

UAE FinTech Startup Trriple will be showcasing Digital Payment Innovations at GITEX. At last year’s GITEX, Trriple launched as a company and signed a partnership with Ericsson on mobile wallet solutions in banking and Smart Cities. Trriple returns this year to showcase digital payment innovations, and exhibit alongside FinTech startups at the GITEX Startup Movement.

Millennials in the UAE are a key target for banks. About 60 percent of the population is under 25 years old, and the GDP per capita is over USD 48,000, the second-highest in the Middle East and North Africa, according to a recent report by the Kuwait Financial Center, Markaz.

“UAE Millennials do not want to wait at bank branches – they want constant, secure, and easy access to their banking and financial from their mobile devices. As a result, more banks are establishing partnerships with FinTech startups, which can drive digital payment innovation with a more agile mindset,” said Abdirizak Ibrahim Salah, Co-Founder of Trriple.

Global investors are pouring money into FinTech firms. Investment grew by 75 percent from USD 13 billion in 2014 to USD 22 billion by 2015, according to a recent Accenture report.