Embracing fintech is not just the future of MENA banks but the future of all banks regardless of their geographical positioning. The future belongs to banks that acknowledge the rising digital demand from clients is not met by simply expanding an IT department. Increased expectations for digital experiences from clients and the many opportunities that new technology provides call for an open business model with a sharp focus on the bank’s core strength – servicing clients.

From our point of view, the bank of the future does not develop much technology itself. The bank of the future helps its clients navigate through the increasingly complex world of apps and smart fintech solutions by handpicking the best solutions and packaging them effectively. By adhering to this platform or marketplace model, banks can build a low-cost, flexible and state-of-the-art client experience. The flexibility of having an open model makes it easy to add new services, without adding high costs and complexity.

Outsourcing is now more widely adopted by institutional trading firms and is key to the future. Outsourcing to partners means you can benefit from scale and provide ‘best of breed’ products and services to a wider customer base quicker and with less Capex / Opex, rather than using your own limited capabilities as a bank to deliver sub optimal products and services. The outsource / partner model is absolutely key in finance now as customers become better informed, seeking better experiences and more diversified and comprehensive services and products from across the globe. You can no longer just provide a local / regional menu of products; as has been the case in the region up until now.

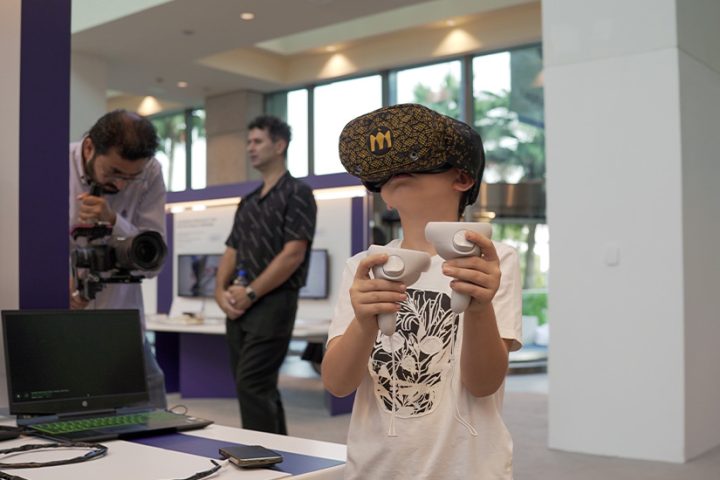

This is where the buzzword “fintech” comes into play. Fintech is a term that has grown in notoriety to be associated with disruption, creativity and opportunity. The dynamics of the MENA banking and investment markets mean that the region’s banks are ripe to benefit from disruption, and from fintech firms with workable, efficient solutions.

But what makes the MENA market so appealing to fintechs? We have seen some seismic shifts in the perception of MENA markets internationally in the past few years, especially with the upgrading of the UAE from frontier to emerging markets, followed by Saudi and soon Kuwait. Within the region, the UAE has embraced fintech the most and is ready to increase its investment in innovation and disruptive technology.

Now it is the case that – on an institutional level – global financial institutions have to be involved in these markets and subsequently we are seeing an increase in capital flow, and a need for better infrastructure to handle these capital flows. In the Saudi market from the start of 2019 through July 31, trading activity of foreign investors totaled $56 billion, representing 21% of total trading, according to the filing, boosting the Saudi index: TASI up nearly 20% at its peak in May.

These figures underpin how markets in the GCC are young but maturing very quickly and are keen to embrace new technology in order to catapult themselves ahead of older and more established markets who are being held back by legacy systems and infrastructure. Indeed, these countries see fintech initiatives and hubs as a way to become relevant in the global market-place and steel the limelight away from bigger centers.

On a retail investor basis, the MENA countries, particularly in the GCC, have long been a magnet to expats who often come to the region to create personal wealth and return to their home countries in better financial positions. This mass affluent sector offers a huge opportunity for MENA banks to utilize innovative fintech offerings to drive digital cross border trading, repatriation and wealth management services in an efficient and scaled fashion.

Traditionally, banks have assigned private bankers to HNWIs and UHNWIs in the region but have under-served the mass affluent segment, who also suffered from undisclosed high costs with independent advisors. Today, with new regulations and technology available there are huge opportunities for banks to target this segment with a scalable and cost-effective proposition.

For the past 25 years, Saxo Bank has strived to democratize trading and investment, so this is a topic close to our hearts. We believe that access to global capital markets should not be the privilege of a select few. Everyone should have the freedom to control their investments and plan their savings to support their goals. For the past 25 years, we have looked at what opportunities and services were available to large financial institutions and used cutting-edge technology to perfect, package, and scale the solutions and make them accessible to a wider audience.

Fintech offers a new solution for MENA banks that can help them to reach new audiences, scale their offerings in an efficie