CONTEXT ChannelWatch 2019 covers the sell-out process from 6,500+ B2C and B2B resellers in 15 countries including IT products and services, investments and sentiment.

CONTEXT ChannelWatch 2019 is an online reseller survey providing insights into reseller behaviour in the IT channel. The report profiles the activities of a representative sample of 6,582 resellers operating in the following countries: UK & Ireland, France, Germany, Spain, Italy, Portugal, Poland, Czech Republic, Baltics, Russia, Turkey and South Africa. This sampling of resellers across twelve regions, 15 countries including Ireland, and three Baltic states, provides insights into geographic trends as well as reseller priorities and issues.

CONTEXT analyses all transactions into respective sales channels through its proprietary reseller database which contains 9 million raw names categorised into 250,000 unique resellers. CONTEXT uses these reseller metrics to provide an objective measure of the change in the reseller landscape. The survey tells us what resellers say they are doing; the reseller metrics provide independent verification that this is what they actually are doing.

Despite the economic headwinds of slowing GDP in Germany, the uncertainty of Brexit, and the ongoing trade war between China and the US, resellers have shown themselves to be resolutely optimistic, proving that the IT industry is in good health. While growth in the nine months ended 30 September 2019 was slower than in 2018, when the CONTEXT panel grew by +6.7%, it remained robust at +3.4% in the ChannelWatch countries. +4.6% when Russia and Turkey, where performance has been negative, are excluded.

Resellers are more optimistic about the coming twelve months than they were a year ago. There have been sizeable increases in net reseller sentiment in the UK & Ireland and Germany, and countries such as Italy and Spain, where it was also high last year, have maintained their level of optimism. The notable exception is Turkey, although there has been a marginal downward change in France. After a difficult year, it is encouraging to see that Russian resellers are maintaining their positive outlook, and this augurs well for 2020.

The health statistics show resellers are sticking with traditional IT products, such as PCs and printers, while also moving into new areas, such as hyper-converged infrastructure and smart home. They are also spending more money per reseller in almost all categories.

HCI systems, which underpin the growth of datacentres, are attracting more resellers, with the hardware elements garnering particular attention. This represents a massive opportunity for the channel. The reseller metrics show that integrated systems purchases per reseller went down in 2019 because the number of resellers in this market increased by +19.3% whereas purchases growth was only +7.7%.

Internet of Things IoT is growing rapidly and 18% of resellers want to introduce it into their portfolio next year. This will engender an explosion of cloud-storage capabilities, which will in turn drive demand for traditional IT products such as servers.

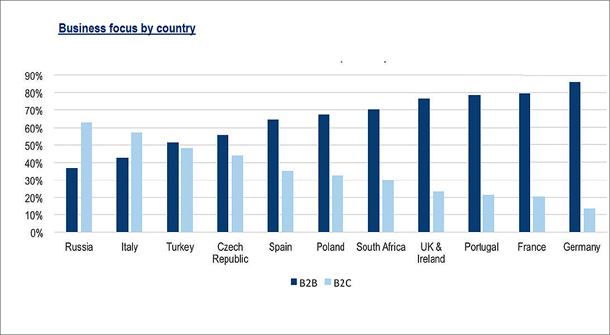

Digital transformation is the nexus of growth for the channel. B2B resellers are more optimistic than their B2C counterparts. They see more opportunities in the growth of activity driven by digital transformation. There is only one country in which B2C resellers are more optimistic than B2B – Italy.

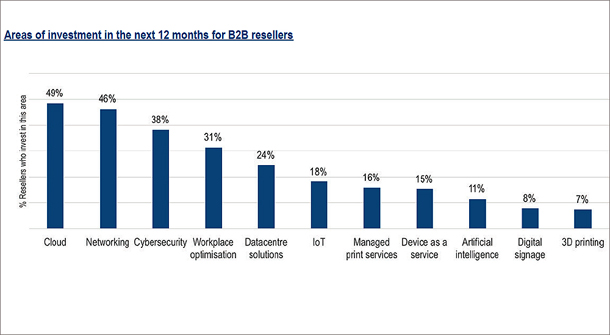

B2B resellers see four top investment priorities – cloud, networking, cybersecurity and workplace optimisation – which reflect their customers’ agenda of digital transformation. 20% of resellers have developed their own intellectual property by, for example, engaging in software and database development; this puts them in a strong position to benefit from digital transformation projects.

The motivation to be part of this IT revolution is evident: 75% of resellers say they are excited about digital transformation, and 77% want to learn more about it. The success and relevance of the channel are not guaranteed – there are still many resellers who are holding back from investing in digital transformation 52% overall, and as many as 73% of resellers in some countries, such as Italy.

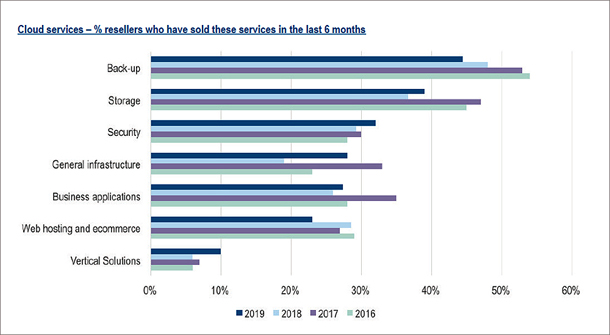

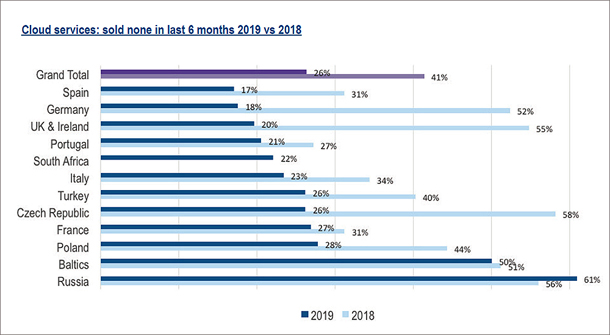

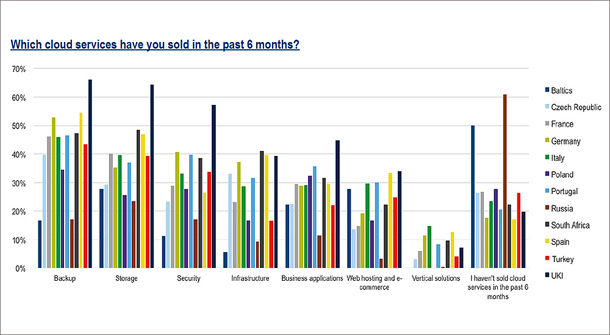

The number of resellers who have sold no cloud services in the last six months has gone down dramatically: from 41% in 2018 to 26% this year. Answers to the question, what cloud services have you sold in the last six months? shows that sales have fallen in only two areas since last year – back-up and webhosting – while those in all other areas have increased.

In security, the increase has been driven by the risk of cybercrime: managed security services make sense for resellers and for their clients not only because patches and regular maintenance are taken care of but also because increasingly mobile workforces and the growth of bring your own device make a cloud solution a good fit.

Vertical-based applications, which still represent only a small part of reseller activity, grew in 2019 and, for the first time, the percentage of resellers who say they sold vertical solutions in the last six months reached double figures. This area adds a huge amount of value and we expect it to continue to grow over the next few years.

Dramatic reduction in % resellers who sold no cloud

The % of resellers who have sold no cloud services in the last six months has gone down in all countries except Russia, another measure of progress of cloud sales in this period. A breakdown of responses shows that cloud services are being sold mainly in the backup, storage and security areas across the board. Across all countries except Russia, a significant number of resellers intend to invest in the provision of cloud products and services.

Many distributors are already investing large sums into building one-stop marketplaces for provisioning, management and billing across vendors as well as offering online marketing tools and the option to white-label some services. As such distributor marketplaces mature, reseller investment in the area will become less necessary and we therefore suspect that, in future years, the number of survey respondents active in this area will decline.

The decline in sales of backup services continued this year, and storage sales were on a par with those in 2018. This could be attributed to customers either returning to on-premises backup and storage, to reduce costs, or simply purchasing directly from the vendor. Security continues to be – and always will be – a hot topic: because cybercrime can be very lucrative, criminals are continually innovating.

Recent scams include using artificial intelligence to imitate a trusted person and so fool a human being into divulging sensitive information. Security is commonly considered to be the largest growth area for the channel, and it is also an area where customers are willing to spend. Managed security services make sense – not only because patches and regular maintenance are taken care of, but also because a cloud solution is a good fit for mobile workforces and BYOD, both of which are becoming increasingly common.

While there has been a marked improvement in sales of infrastructure services since 2018, levels are still below those of 2017. It is an area in which hyperscale vendors would love to see more growth, however, more analysts now acknowledge that these services are really only appropriate to specific use cases where a good return on investment is possible.

That 10% of respondents now offer vertical solutions is a sign that resellers are finding a niche in which to work. To do well in a particular industry, a reseller needs to both be a subject-matter expert and know how to sell and integrate solutions to solve common problems within the field. They need to build repeatable solutions that drive greater economies of scale to increase profits. This can be a challenging process and it takes time and investment. It is, therefore, unsurprising that only a comparatively small proportion of resellers operate in this area.

Cloud is high, AI is low, for reseller investment

Over the next 12 months, B2B resellers intend to invest primarily in provision of cloud products and services, networking, cybersecurity and workplace optimisation. Datacentre solutions also scored reasonably highly. Device as a service, artificial intelligence, digital signage and 3D printing were low on the priority list for these resellers.

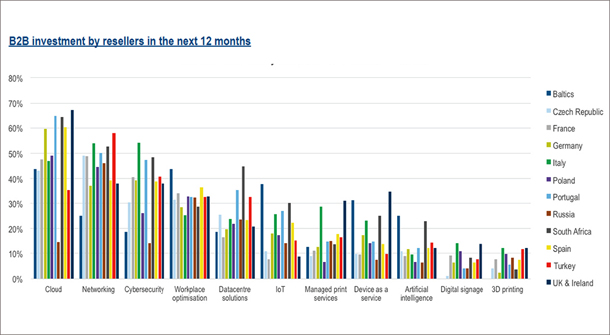

The investment areas identified by resellers were fairly consistent across countries. The notable differences are that Russian resellers were far less interested in provision of cloud products and services, and Russia and the Baltics were relatively less interested in cybersecurity than other countries.

This may be because cloud infrastructure, which requires strong cyber-protection, is relatively underdeveloped in these countries, and backing-up data is considered more important than protecting it. This is related also to a general lack of customer and market education in cybersecurity, which clearly manifests itself in a lack of intended investment in this field.

In fact, many Russian resellers commented on poor availability of training and some also voiced concerns about a lack of educated and skilled people.

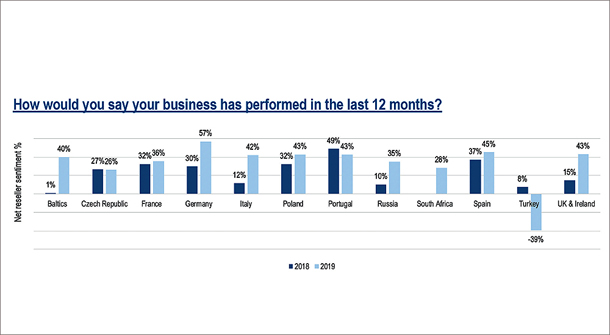

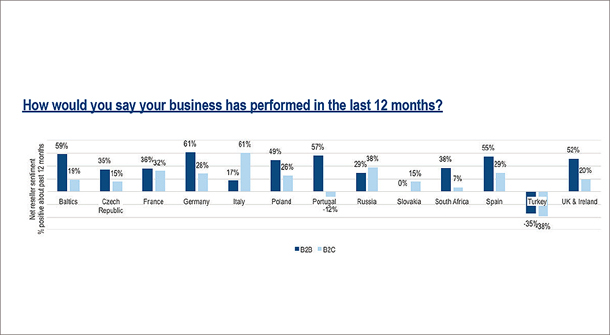

How have resellers performed in last 12 months?

Reseller sentiment is based on the response to the question, How, would you say your business has performed in the last 12 months? The net % is calculated by deducting the % who respond not well from the % who respond well. Responses of OK are ignored. Reseller sentiment has strengthened considerably since 2018, with one major exception: Turkey has been through a turbulent time following the devaluation of the lira and has faced other political and economic challenges.

In 2019, for the first time, we have analysed the responses of resellers into B2B and B2C. The results are telling: they show a notable difference between the two categories, with B2B resellers expressing a more positive opinion than B2C resellers – except in Italy and Russia – reflecting a lack of consumer confidence that appears to be felt across all countries.

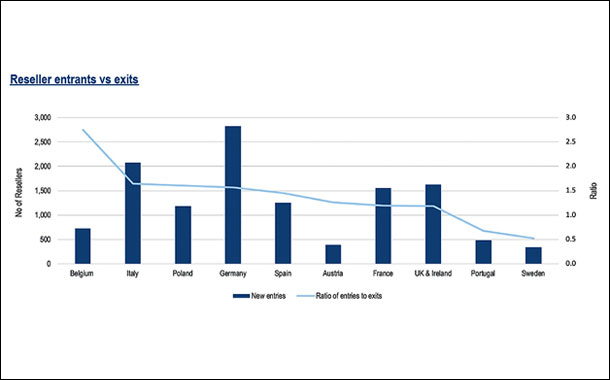

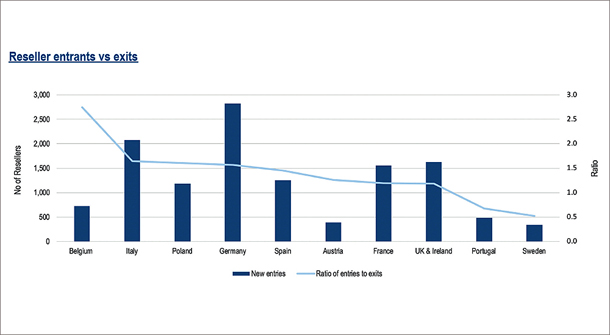

Entry and exit of EMEA resellers

In the period Q3 2018 to Q2 2019, there were a total of 122,368 IT resellers through whom the distributors on the CONTEXT panel sold products and services to end customers in ten of the twelve ChannelWatch countries. This is a +2.7% increase on the 119,193 in Q3 2017 to Q2 2018, which demonstrates the overall stability of the market.

Over these twelve months, the average purchases per reseller increased by +3.7% from EUR 486K to EUR 504K, and the figure was considerably higher in the UK & Ireland, where the spend per reseller was EUR 843K. The graphic is sorted by ratio of entries to exits, in descending order. The renewal profile of the reseller base varies from market to market and year to year.

Last year, three major economies, UK and Ireland, Spain and Italy, had replacement rates below the equilibrium level whereas this year, in almost all countries, Portugal and Sweden are the exceptions, more resellers joined the market than left it. Belgium is the outlier with many more new entrants than leavers as well as large growth in the total purchases by resellers, indicating a thriving channel.

Content and graphics excerpted from CONTEXT ChannelWatch 2019.