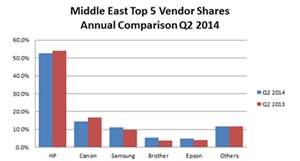

However the overall Middle East market expanded 9.4% in volume

The Middle East hardcopy peripherals (HCP) market overcame a conspicuous downturn in Turkey to post strong year-on-year growth in Q2 2014, according to figures released today by International Data Corporation (IDC). The research and advisory firm’s latest Quarterly Hardcopy Peripherals Tracker shows the overall Middle East market expanded 9.4% in volume and almost 7% in value during the second quarter of the year.

The Turkish market’s decline was primarily brought about by firms postponing their purchases as they waited for the outcome of the presidential elections held in the country earlier this month. However, most of the region’s other key markets posted significant double-digit growth, resulting in the strong performance recorded for the overall region. Robust domestic infrastructure investments in the key markets of Saudi Arabia and the UAE had a particularly positive impact on demand for hardcopy devices.

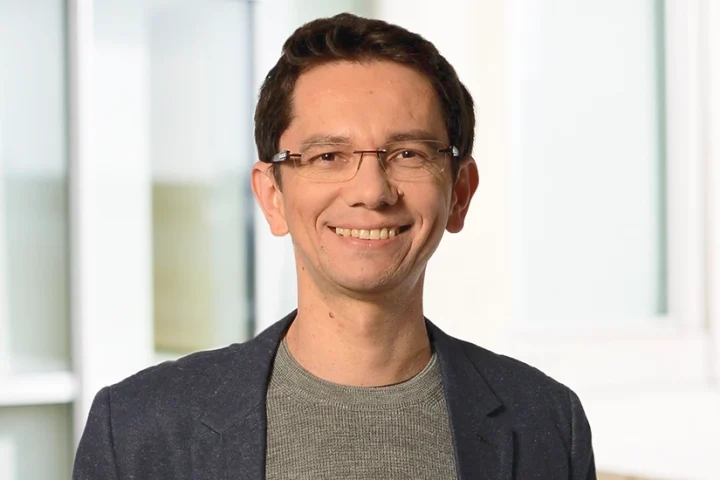

“The color laser market continues to register the region’s most impressive volume and value growth rates, but we are also seeing strong shipment growth across most speed segments of the mono laser market,” says Ashwin Venkatchari, senior program manager for imaging, printing, and document solutions at IDC Middle East, Turkey, and Africa. “The focus of vendors on pushing entry-level mono laser devices into the region has had a significant impact on shipment growth in most of the major Middle East markets. And despite the volatile political climate seen in certain parts of the region, the ongoing reliance on hardcopy documents by businesses is continuing to drive considerable demand for HCP devices.”

Inkjet shipments across the Middle East declined 2% year on year in Q2 2014 to total 315,000 units. However, the inkjet market’s value increased 15% over the same period to cross the $34 million mark, courtesy of a strong performance in the $400+ category as new high-speed inkjet models designed for businesses gained traction in the region.