Siemon expects demand for infrastructure that enable scalability and migration to higher Ethernet speeds without disturbing installed infrastructure.

Undoubtedly, the global Covid-19 pandemic had and continues to have a major impact on every facette of daily life and the day-to-day business in many frontline industries. The IT industry however has seen strong growth in certain sectors with Siemon having experienced tremendous growth in the datacentre market throughout Q3 and Q4.

Here, the change from office-based to remote working has hugely accelerated digitalisation and data traffic, which in turn has initiated stronger demand in datacentre services and this will continue into 2021. Although investment into LAN infrastructures, like new offices has declined, Siemon still expects this market to grow in 2021 in various other verticals, albeit at a much slower scale but driven by a hybrid working model partly office-based and partly remote working.

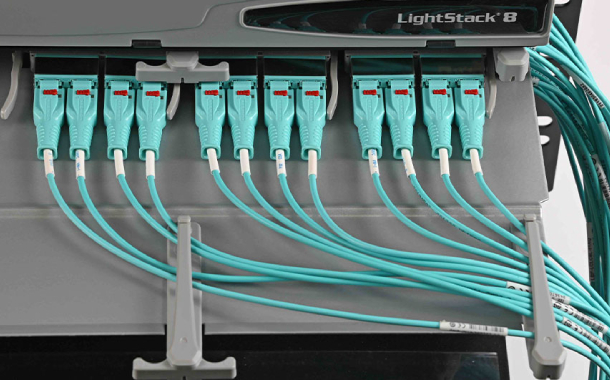

In the datacentre space, Siemon expects greater demand for infrastructure solutions that enable scalability and easy migration to higher Ethernet speeds without disturbing the installed infrastructure and risking downtime. With speeds swiftly moving from 10 to 40 and 100Gbs, migration must be well panned and well-designed and requires a much more consultative approach tailored to individual customer needs.

In addition, Siemon expects higher demand in solutions that maximise available datacentre space for example, in colocation facilities. These can include high density cabling and connectivity, for example, enclosures holding larger amounts of fibres, smaller diameter cables, and connector designs that allow for easy access in the tightest of datacentre spaces.

Datacentres will see accelerated growth across the Middle East driven by a growing trend in greener, more energy efficient datacentres and a rise in edge datacentres which are required to support smart cities developments across the region. Almost every business is now adopting a cloud strategy which in turn accelerates datacentre requirements.

Looking at vertical markets, Siemon sees increased government spending and governmental support to further drive digitalisation. Other verticals include the healthcare and pharmaceutical sectors where IT investment aims at improving the quality and capability of healthcare facilities.

The education sector is also likely to experience further growth due to continued remote online learning audio video streaming, which will require higher IT infrastructure and datacentre spending. Siemon will continue to work alongside its complementary manufacturers eco system to meet customers’ growing demands for high performance datacentres as well as helping them achieve intelligent smart building solutions.

Siemon has always been very dedicated to sharing its technical expertise and to helping infrastructure managers understand how the latest technology can future-proof their networks and will continue to provide technology and services that optimise datacentre and intelligent building infrastructures.