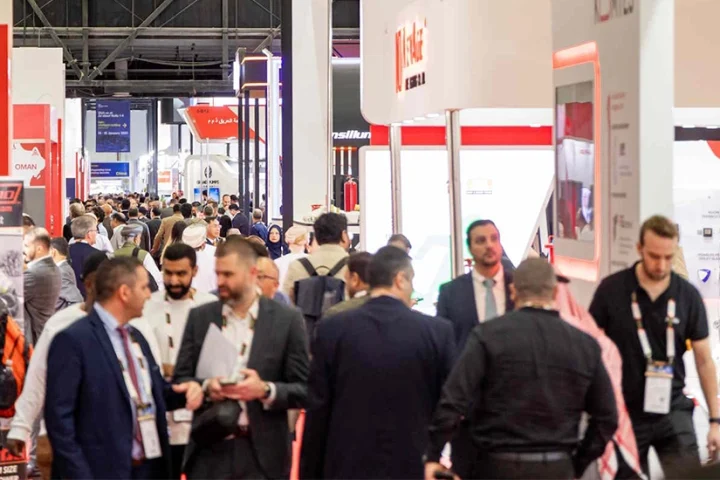

With the introduction of the 5% value-added tax law in the UAE, companies today face the challenge of digitising and securing their business transaction history. The federal law mandates organisations maintain accounting records – like sales invoices, import and export records, accounting books and purchase invoices – in paper or electronic format for a period of at least five years post each financial year.

However, storing transaction information in a paper format creates a lot of administrative work, inefficiencies and additional costs.

To make VAT compliance a reality but not a headache, companies must leverage IT solutions that store and manage sensitive information. Digitalising VAT related documentation will help organisations automate internal procedures, provide a convenient storage archive that can be referred to at any time, and stay in line with the government standards.

Consider the following five steps in preparing for the VAT mandate:

Digitise

Digital documents are easier to manage and audit than paper documents, so the first step is to transition all hard copy documents to digital.

Classify the content

With the help of artificial intelligence, automated classification solutions can identify document types and classify them through a combination of text and image-based analyses. Machine learning makes assigning digital files very easy while minimising the time taken to manually categorise paper transactions.

Extract key figures

Once documents are captured and classified, data within the file can be extracted using Optical Character Recognition, an advanced technology that helps convert scanned documents into an editable format. The extracted information is then fed and collated into solution empowered devices to identify patterns in transactions and make intelligent decisions.

Validate transactions

Automated validation involves integration with other data sources such as an existing database or enterprise application. Manually validating transactions is a time-consuming process and risks human errors. On the other hand, digitally automating the validation process means the business will have more accurate scripts while saving time.

Deliver online

Digital data, images and documents can be exported and made available to other content repositories, databases, and business systems in a variety of formats.

After the digital system and processes are in place, they can be scaled to suit the volume of work in the organisation. A well planned and implemented system will save time, reduce costs and digitally improve productivity in document management.

It will also allow the company to remain VAT compliant and enable critical documents to be shared through e-government platforms when required.

Key takeaways

- After the digital system and processes are in place, they can be scaled to suit the volume of work.

- A well planned and implemented system will save time, reduce costs and digitally improve productivity in document management.

- With the help of artificial intelligence, automated classification solutions can identify document types.

- Machine learning makes assigning digital files easy while minimising the time taken to manually categorise paper transactions.

- Manually validating transactions is a time-consuming process and risks human errors.

- Digitally automating the validation process means business will have more accurate scripts while saving time.

Soaring volumes of data means businesses can no longer keep paper records and must opt for digital solutions explains Chris Govier at Xerox Emirates.