On 9 October 2018, the Kingdom of Bahrain released its Value Added Tax Law under Royal Decree No 48 of 2018. The VAT implementation date will be 1 January 2019. Bahrain’s VAT Law differs in key areas from corresponding legislation introduced in Saudi Arabia and UAE in that it provides for broader zero-rates and exemptions, with a view to balance a range of relatively unique socio-economic objectives.

In November 2016, the Gulf Cooperation Council Member States executed the Common VAT Agreement of the States of the GCC, outlining the framework that member states should follow when implementing their domestic VAT rules. Saudi Arabia and the UAE implemented their VAT systems on 1 January 2018. Bahrain released the VAT Law on 9 October 2018 via the Official Gazette website. The Royal Decree states that VAT will be implemented on 1 January 2019.

Highlights of the Law

Article 4 of the Royal Decree states that the Law will come into force on 1 January 2019. In accordance with the GCC VAT Agreement, Article 2 of the Law provides that the supply of all goods and services made in Bahrain, as well as imports, shall be subject to VAT. Article 3 of the Law provides for a standard rate of 5%, while certain goods and services may be subject to a zero-rate or exempt from VAT. Article 53 of the Law sets out provisions where certain supplies and sectors are subject to the zero-rate of VAT subject to satisfying conditions and procedures.

In summary these include: oil derivatives and gas sector, foodstuffs, local transport, international transportation services, construction of new buildings, educational services, preventive and basic healthcare services, supplies of certain medicines and medical equipment, export of goods, export of services, supply of goods under a customs duty suspension scheme, import of investment gold, silver and platinum, import of pearls and precious stones.

Articles 54 to 56 set out the scope of exemptions. In summary these include: supply of financial services, supply of vacant land and buildings, where the supply of goods in the final country of destination is exempt or zero-rated, goods that are exempt from customs duty, diplomatic exemptions, military exemptions, used personal effects and household items, personal luggage and gifts carried by travelers, necessities for people with special needs

Article 51 provides that import VAT should be paid to the customs authority, where Bahrain is the first point of entry. Tax authorities may allow the taxable person to defer the payment of VAT until submission of the VAT returns.

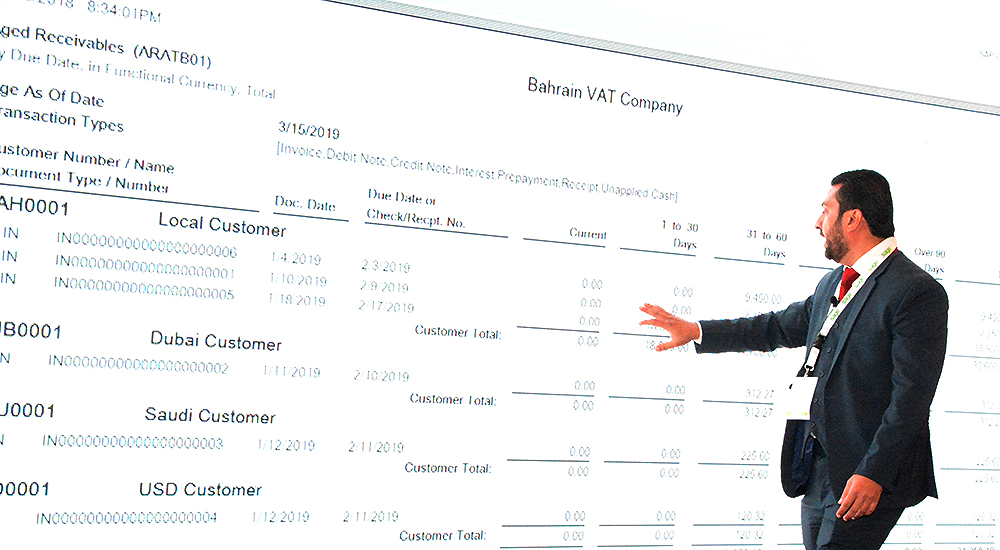

In order to prepare financial decision makers in Bahrain to prepare for these process changes, with effect from 01 January 2019, GEC Media Group organised the Tax transformation Workshop in Bahrain. GEC Media Group, publishers of Business Transformation, Enterprise Channels MEA, The Titans, Cyber Sentinels, successfully completed the Tax Transformation Workshop on 19 December in Bahrain. The workshop was held in partnership with AI Society Bahrain, Affiniax Partners, Sage Middle East, and Valto Technologies. Close to 75 senior and middle level financial executives attended the workshop at the Gulf Convention Centre, with the total number of attendees closer to 100.

The event was kickstarted by a key note from Dr Jassim Haji, President of The AI Society Bahrain. His topic was titled – Using AI and Machine Learning technologies in VAT implementation. This was followed by an overview of the VAT guidelines due to be implemented in the Kingdom of Bahrain by 01 January 2019 by Tanmay Saxena, Head of Department, Tax Services at Affiniax Partners. Saxena also presented how the GCC VAT framework will impact business in Bahrain.

Mansoor Sarwar, Director of Technical Services at Sage Middle East, presented both a global and regional overview of how the VAT tax system benefits governments and how it will help GCC nations reduce their budget deficit in the post-oil economy. Sarwar explained the fundamentals of the VAT process, elements of VAT invoicing, and other guidelines to be kept in mind while implementing the VAT taxation system. Sarwar also explained the Sage software application and the various features that enable VAT reporting and VAT analytics.

“At Sage, we develop solutions to aid businesses of all sizes in delivering quality products and services to their customers. With the introduction of VAT earlier this year in UAE and Saudi Arabia, we rolled out tax-compliant software in the GCC region to help businesses adjust easily. We have tailored our products to suit each country’s VAT law and currently, we are customising software solutions that comply with Bahrain VAT laws as more details emerge,” said Mansoor Sarwar, Director of Technical Services and Pre-Sales, Sage Middle East, during the workshop.

The hands-on explanation of the Sage application was continued by Faraz Afzal, Pre Sales Consultant at Sage Middle East. The concluding key note session was delivered by Vinayan P, CEO of Valto Technologies on SWOT analysis of document management. All the delegates engaged in a lively question and answer discussion during the individual sessions. Networking between the event partners, delegates and attendees continued into the lunch break.

With the implementation of VAT across the countries of the GCC, businesses need to invest in an accounting solution that streamlines tax collection, record-keeping, and reporting processes. The solutions from Sage, include essential elements for a start-up, small and medium businesses or enterprise, needed to run with efficiency and flexibility.

“Some businesses may find adapting to new changes challenging at the beginning, but with the right support, the transition can be smooth. Business owners should view VAT as an opportunity to support the local economy, boost corporate transparency and optimise operations – not as an administrative burden or a daunting task,” advised Sarwar at the end of the workshop.

Solutions from Sage

Sage Accounting offers easy to use online accounting software that supports entrepreneurs and small businesses. Accessible 24×7, it allows businesses to grow and offers a simple way to get things done. Sage Accounting is for start-up companies, valid in UAE but the VAT module is not yet customized for Bahrain.

Sage 300 Cloud makes it easy to manage mobile and distributed medium-sized to large business. Whether the business operates as one company, 10 divisions, or 100 entities across the Middle East, Sage 300cloud helps to connect business and speed up growth, without the cost or complexity of traditional ERP software. Sage 300 Cloud is for SMBs and has been tailored to comply with Bahrain laws.

Sage Business Cloud Enterprise Management takes the complexity out of running business. It simplifies operations, leaving them lean and ready for whatever comes next. Sage Enterprises is suitable for larger enterprises.

Role of Federal Tax Authority of UAE

The Federal Tax Authority of UAE, the government entity responsible for the collection and management of federal taxes in UAE, was established in 2016 by the President of the UAE, His Highness Sheikh Khalifa Bin Zayed Al Nahyan, via Federal Decree-Law No 13 of 2016 on the establishment of the Federal Tax Authority.

Its mandate includes:

- Achieving economic diversification through fiscal best practices

- Increasing the UAE’s non-oil revenues

- Reducing dependence on oil resources in preparation for the post-oil economy

- Enhancing UAE’s economic sustainability

- Helping business community understand responsibilities with regard to taxation

The software application vendors that have FTA UAE compliant solutions, and are UAE VAT ready include: Zoho Corporation, Tally Solutions, Sage Group, Focus Softnet, RnR DataLex, Circuit Computer, SAP, Versify, Dolphin Solutions, FACT Software, First BIT, Posibolt Solutions, Dear Systems, AJ Technology, DCS Infoway, FACTS Computer Software, PayMyVAT, Dsoft, Digital Research Lab, Newage, Genibooks, SunTec, Coral Business Solution, Microsoft Dynamics, Reach Business Automation Software, Way Point System, Bisan.

The Gulf region including the Kingdom of Bahrain, has long been considered an attractive and low-tax environment. However, to keep up with the changing economic landscape and as part of wider development reforms, the Gulf Cooperation Council member states signed a framework agreement to introduce Value-Added Tax on the supply of goods and services at a standard rate of 5%, in 2018. Implementing VAT will have implications for businesses and new taxpayers, both in Bahrain and abroad. However, a broad-based VAT at a low rate is unlikely to deter investment into Bahrain, or the surrounding region, whose appeal stretches much further than its low-tax status.

Infrastructure development, access to high-potential growth markets in Africa and Asia, free-trade zones, competitive labor costs, few trade barriers and economic and political stability are all factors which add to the region’s appeal. In addition, VAT will have a neutral impact on registered businesses when managed efficiently.

The Unified Agreement for VAT of the Cooperation Council for the Arab States of the Gulf, sets out the framework under which VAT can be implemented in each of the GCC member states. The framework includes agreement on certain matters and in addition, requires member states to implement mandatory local legislation whilst allowing discretion on how to handle other related issues.

Once the agreement is ratified, each member state must integrate the framework into local law and implement VAT. The framework allows for a basic rate of VAT on supplies of goods and services of 5%, as well as allowing certain supplies to be zero-rated or VAT exempt depending ultimately on the domestic legislation of each country.

VAT is a tax on the consumption of goods and services. It is charged and collected by a taxable person and remitted to the tax authority. A taxable person, being a natural or legal person, is a person, who carries out economic activity that requires them to be VAT registered. The VAT framework comprises of 15 chapters and 79 articles.

VAT impacts every business that supplies goods or services in the GCC countries. In particular, businesses that make taxable supplies over the mandatory threshold, must register with the relevant tax authority. There is scope for voluntary registrations and VAT registration requirements will apply to non-resident entities. Additionally, there is scope to register multiple entities as a single VAT group, subject to conditions to be set out in the domestic legislation of each GCC country.

VAT will vary depending on the local VAT regulations for each member state, according to the place of supply. The place of supply of goods is where the goods are disposed of or used by the customer. The place of supply of goods provided with transport is the place where the transport starts.

A taxable person will be entitled to deduct the VAT amount incurred input tax in carrying out their taxable supplies from the VAT due on the taxable supplies made output tax. Evidence of VAT charged and paid must always be available, typically a tax invoice. Each member state will adopt its own conditions for VAT deduction.

There are special rules which transfer the place of supply of goods with transport to the customer if they are a VAT registered entity in another member state. For services, the place of supply is where the supplier is resident. However, the place of supply of services provided to a taxable customer shifts to where the customer is established. Taxable supplies include all supplies of goods and services and transactions that are deemed to be such supplies for example, transfers of stock abroad and either subject to the 5% VAT rate, zero-rated or exempt.

This includes:

- all goods or services, transfers of ownership, disposals, leases, rentals and construction used in business

- transfers of goods and services from and to other GCC countries

- transfers of goods and services from and to the rest of the world outside the GCC

- deemed supplies

- import of goods and most services

Zero-rated VAT

Zero-rate VAT is still a rate of tax for a taxable supply. Consequently, a supplier of zero-rated goods or services is entitled to a credit for the VAT incurred on costs. In contrast, VAT exempt is not a rate of tax and is not a taxable supply. Those taxable persons making VAT exempt supplies may not claim credits on the VAT incurred on their costs. This results in a higher cost for VAT exempt suppliers.

Imports refer to goods entering the GCC countries from outside the Gulf region. VAT is typically due on imported goods, however there are special rules regarding the valuation of imported goods and goods under suspension as per Customs regulations. Exports refer to goods transported outside of the GCC. Exports are typically zero-rated, subject to certain conditions.

There are special provisions for the place of supply of the following:

- medicines and medical supplies, common list to be determined by the Committee of Health Ministers

- basic food items, common list to be ratified across the GCC

- oil sector, at the discretion of the member state

- international and intra-GCC transport

- transport, at the discretion of the member state

- supply outside the GCC for example, exports

- supply of investment gold, silver and platinum

Additionally, member states can choose to zero-rate or exempt the following sectors:

- education

- medical

- oil, gas, water, electricity

- transport services for goods and passengers

- services to real estate properties

- supply of telecommunication and electronically provided services

- supply of restaurant, leisure, cultural and sporting events

VAT exempt

Financial services carried out by authorised banks and financial institutions will generally be VAT exempt. Exempt services are not taxable supplies and therefore supplies made to a taxable person making exempt supplies would not be able to recover any input VAT incurred. Financial institutions may however be afforded the right to a refund of input tax, based on refund rates determined at the discretion of each member state. Member states also have the discretion to apply any other tax treatment to the financial services sector.

Excerpted from Analysis of the GCC VAT Framework Agreement by KPMG.