If reports and studies stand true, the GCC and Africa region is all set to touch 100 million mobile subscribers by 2020. What would it take to retain customer loyalty whilst going uncompromised on service?

Gone are the days when subscribers just expected seamless connectivity from service providers. The service providers are under tremendous pressure to rise up to the age of transformation. Apart from connectivity, users wish for a great buffet of services like VPN, WAN, security and IoT from the service providers that not only leverages the existing models of communication and networking technologies, but also puts it parallel with the digitization models. If reports and studies stand true, the GCC and Africa region is all set to touch 100 million mobile subscribers by 2020. What would it take to retain customer loyalty whilst going uncompromised on service?

THE WAKE UP CALL

As the day-to-day life of consumers become digitized, the opportunities have widened for the service providers. It is a wake-up call for the telecom service providers to take the services to the next level by bringing in the best of all the world that includes IoT solutions, digital services, VR and AI. Consumerization of business has changed the way customers demanded and behaved. As Mark Ackerman, Sales Director, Middle East, ServiceNow remarks, “Younger generation will be expecting the same levels of service within the workplace and will continue to push the boundaries where they can. This pressure for “instant gratification” combined with a “new normal” for the economies struggling to adapt to the lower oil prices will ultimately force the enterprises in the GCC to look to enable business faster, to modernize systems and ultimately to look for opportunities for automation.”

A NEW CONSUMER REALITY

Of course, understanding the customer is the first step towards understanding the digital journey. Cloud is undoubtedly the new reality for sectors across the spectrum, so is it for telecom. Recently, Etisalat Group, in association with Deloitte and Huawei, announced the launch of a joint White Paper entitled “From Pipelines to Clouds – Etisalat`s Playbook”. This White paper intends to share the lessons learned and the point of view on the road towards a cloud-native Telco, ultimately making a contribution to the telecommunication industry.

This White Paper will also indicate how all these technologies combined can elevate a Telcos’ capabilities to revamp their business.

The challenge that service providers are facing at present is beyond the likes of what they have faced before. Service providers by default leverage the latest communication and networking technologies to generate growing services for their consumption target markets. However, the challenges of today require large scale business and organizational changes in addition to adopting the latest digital technologies,” says Ali Amer, Managing Director, Global Service Provider Sales, Cisco Middle East and Africa

The challenge that service providers are facing at present is beyond the likes of what they have faced before. Service providers by default leverage the latest communication and networking technologies to generate growing services for their consumption target markets. However, the challenges of today require large scale business and organizational changes in addition to adopting the latest digital technologies,” says Ali Amer, Managing Director, Global Service Provider Sales, Cisco Middle East and Africa

EMERGING TECHNOLOGIES SETS THE STAGE

According to an EY study, Smart services are firmly in focus for the telecom sector. In the survey, Every telecommunications player in the region sees customer experience as a top-three agenda item while three in four also cite cost control compared with one in two

participants globally. Thirty-eight percent of Middle East respondents cite developing new services as a top three strategic priority, compared with 29% of total respondents. Digital transformation is playing a vital role in not only improving the overall efficiency of the Telecom Sector but also truly redefining the Telecommunication services. In Bahrain, digitization is at the top of the agenda for the Telecom companies, especially driven by the policy initiatives of the Government.

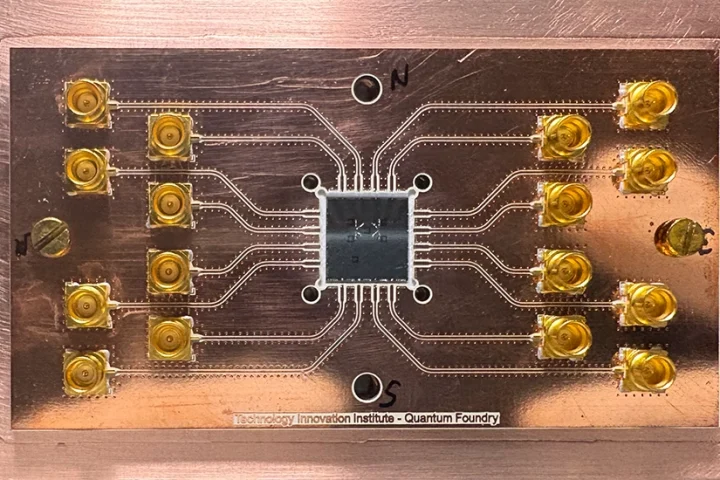

According to Cisco, In another area of transformation, most service providers by now recognize the need for network function virtualization. But the reality is also that most service providers are still at a very early stage of its adoption. Service providers expect network function virtualization to deliver cost savings and bring agility into their business. Amongst the early inhibitors are the inability to build an internal business case for adoption of virtualization, lack of ownership on who will drive the project, lack of software skills to provide sustainability, inability to build an agile organizational structure to justify the migration to an SDN, NFV, DevOps environment, amongst others.

SHERING IN THE ERA OF CHANGE

2017 has been a great year of transformation for the telecom sector. We saw many regional telecom service providers changing the game by taking different roads enroute digitization. For example, Etisalat and RAKBANK signed a Memorandum of Understanding (MoU) for Managed Point of Sale Services. As part of the strategic partnership, Etisalat shall provide RAKBANK with last-mile Point of Sale (PoS) operations as its outsourced and managed service partner, a first-of-its-kind approach in the UAE payments and banking industry. On the other hand, Batelco became the first provider from Bahrain to enable customers around the region to connect directly to AWS infrastructure using the AWS Direct Connect service.

Meanwhile du has announced that it is the first provider in the Middle East to trial SDAN technology on NG-PON and establish an intelligent network capable of supporting future needs. Helping to facilitate UAE’s future ambitions, the trial demonstrates how du can use SDAN to build intelligent networks that can adapt to the changing needs of the consumers. During GITEX 2017, du and Darkmatter also reaffirmed their commitment towards cyber security and offered their respective perspectives on the critical role that cyber security plays for smart and hyper-connected digital environments to reach their full potential.

FINALLY

The telecommunications industry will continue to evolve in a number of new directions. Operators will continue to seek differentiation through network quality and breadth of service portfolio, underpinned by further industry consolidation and the appearance of new technologies to support data needs in the gigabit era. In an increasingly diverse market landscape, EY expects operator strategies to diverge on the basis of differences in geographic scale, level of digital ambition, and contrasting prioritizations of growth and efficiency within their strategic agenda. Yet higher levels of agility, more collaborative mindsets and a recasting of customer relationships will be vital to all.