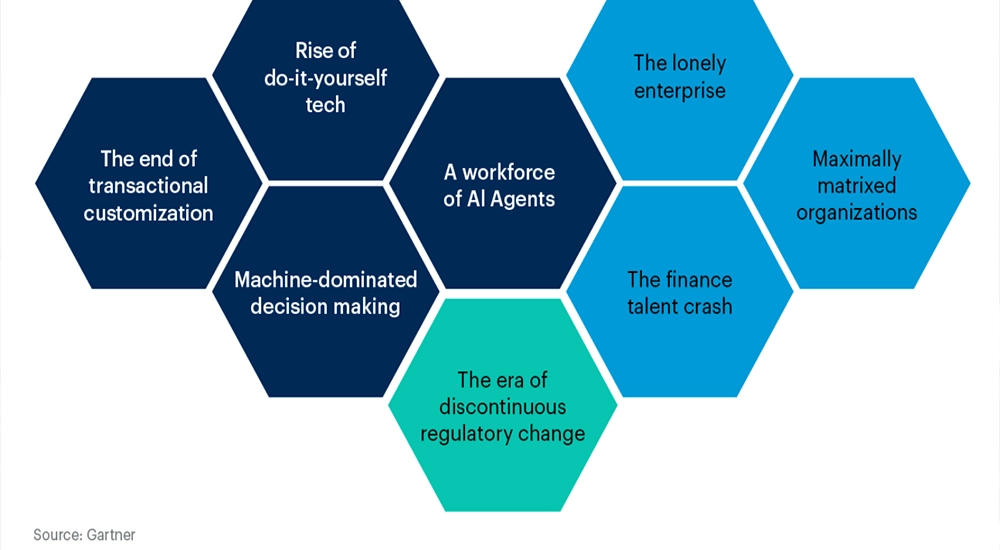

In the coming five years, eight forces will cause the finance function to undergo significant transformation, according to Gartner, Inc., a business and technology insights company.

“These forces will reshape finance through 2030, and CFOs need to rethink how to organize and operate their finance organization,” said Brian Stickles, Senior Principal, Research in the Gartner Finance practice. “CFOs must internalize these forces in order to make complex decisions about the future of the finance function.”

These forces span technological, organizational and regulatory categories, and every CFO will need to ensure their plans for finance account for, and respond to, these eight forces (see Figure 1).

Source: Gartner (June 2025)

- AI Workforce: AI agents will handle tasks autonomously, altering finance processes, vendor relationships, talent needs, and organizational structures. AI will automate many tasks, requiring finance professionals to adapt to new roles as co-workers and coordinators of AI agents.

“Gartner predicts that a third of enterprise applications will have embedded agentic AI by 2030, making 15% of day-to-day work decisions autonomously,” said Stickles.

- Machine Decision Making: AI will dominate routine and complex decision-making, enhancing speed and quality. Finance staff will oversee AI systems, necessitating a shift towards probabilistic thinking and less time spent on the kind of activities currently performed by entry-level roles.

“As soon as 2028, Gartner is predicting 70% of finance functions will be using AI analysis with connected device data for real-time decision making on operational costs and cash flow management,” said Stickles.

- Do It Yourself Tech: Non-specialists will use low-code and AI tools to develop technology solutions, increasing finance’s digital self-sufficiency. This shift will require oversight to manage risks and quality assurance.

“Low/no-code technology use and citizen developers will be widespread within two years,” said Stickles.

- End of Customization: By 2030, most finance functions will have nearly identical transactional processes. This is driven by a positive feedback loop of finance functions converging on best practices and tech vendors and BPOs offering standardized products and services aligned to those best practices, ironing out the disparities in transactional processes.

“Standardized transactional processes will reduce costs and reliance on customized solutions, though analytical customization will remain,” said Stickles. “Finance must prepare talent and systems for this shift.”

- Lonely Enterprise: Employees will become more isolated due to task specialization and increasingly technology-mediated interactions. “Finance will focus on delivering self-service tools to deliver support more efficiently and at greater scale,” said Stickles. ”However, there’s a risk finance employees become more siloed with a degraded understanding of the needs or the organization at large, making it harder for finance to provide quality assurance over decision.”

- Matrixed Organizations: With a greater number of inputs, organizational decision-rights get murky typically resulting in more senior people becoming involved. The further up the hierarchy this goes, the more local expertise can be lost, so finance teams will need to ensure they leverage local expertise to maintain decision quality.

- Finance Talent Crash: With 75% of CPAs in retirement age, and fewer entering the industry, a decline in traditional finance talent will change the talent landscape. Finance will require more technology talent to scale the skills of the remaining finance talent and will have to adapt roles to balance finance and tech skills.

- Discontinuous Regulatory Change: Unpredictable regulations will challenge finance’s ability to maintain compliance and consistency. Finance will need to decentralize and increase staffing to manage localized expertise and rapid scenario analysis.