Stitch has released a comprehensive study examining the technology infrastructure barriers constraining financial innovation across Saudi Arabia and the United Arab Emirates.

The GCC digital banking market is set to grow from USD 12.7 billion in 2025 to USD 47.6 billion by 2032, reflecting expanding opportunities across payments, lending, deposits and related services. Yet fragmented technology infrastructure and persistent reliance on legacy systems are preventing financial institutions across the GCC from capitalizing on growth prospects.

Fragmented legacy technology is leading to missed opportunities for majority financial institutions

While vendor adoption has grown with 87% of banks now relying on external platforms, this shift has not eliminated legacy systems. Instead, modern capabilities have been layered on top of older architectures, creating increasingly complex and unmanageable technology environments. In the UAE specifically, 94% of financial institutions use external vendors, the highest adoption rate in the region, yet this proliferation has increased operational complexity.

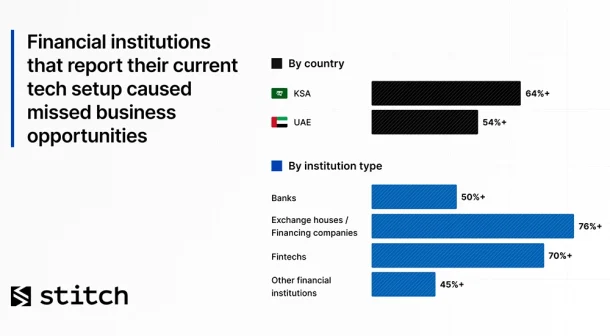

Over half of financial institutions in Saudi Arabia and the UAE report that their current technology stack has caused them to miss business opportunities. Across institution types, 70% of exchange houses and financing companies, 76% of fintechs, 50% of banks, and 45% of other financial institutions have reported that their current technology setup has caused them to miss business opportunities. This data reveals how technology infrastructure is creating disadvantages across institutions instead of accelerating innovation.

1 in 5 describe systems as outdated, thus slowing fintech innovation

Financial institutions cite slow implementation of product launches and updates, integration challenges across vendors and systems, high costs and lack of flexibility. More than one in five institutions describe their systems as outdated or difficult to upgrade.

Across the gulf, 73% of Saudi Arabian institutions and 66% of UAE institutions report being heavily dependent on third parties for product launches and updates. This dependency is most pronounced among fintechs (80%), who rely on vendor release cycles rather than internal roadmaps. Over 60% of institutions that offer lending products currently operate exclusively on legacy systems. Lending remains one of the most risk sensitive and infrastructure heavy functions within financial institutions and modernization challenges explain why vendor adoption and cloud adoption alone have not resolved challenges.

“Everyone talks about digitization and AI adoption across the sector, but the reality is that legacy and fragmented systems still sit at the heart of all institutions. They slow things down, limit progress, and drain budgets; the hidden culprit. As the MENA region continues its unprecedented progress, modern stacks and a unified operating system unlock a new dimension of opportunity and growth,” said Mohamed Oueida, Founder & CEO of Stitch.

Technology upgrades are a priority in Saudi Arabia and UAE but barriers remain

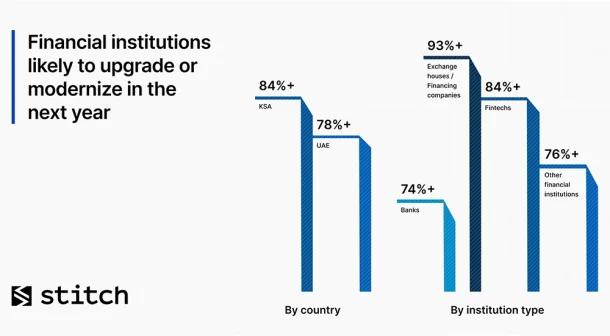

The challenges between modernization ambition and execution constraint are visible in Saudi Arabia as companies progress to meet ambitions central to Vision 2030 economic diversification goals. The Saudi Arabian digital banking market generated revenue of USD 1,094.1 million in 2025 and is expected to reach USD 3,591.9 million by 2033. Yet 84% of Saudi Arabian financial institutions plan to modernize or upgrade their technology within the next 12 months, suggesting that current infrastructure cannot support the speed and innovation the market requires. In the UAE 78% of institutions are planning modernization within the same timeframe. However, high switching costs, long term contracts, regulatory and compliance concerns, and downtime risks are constraining the transition to modern technology platforms.

GCC financial institutions are choosing to shift to homegrown unified platforms

73% of Saudi Arabian institutions and 66% of UAE institutions agree that a single unified vendor would deliver more value than managing multiple disconnected platforms. Regional decision makers increasingly view unification as essential with a focus on outcomes rather than features.

Benefits include easier management in a single place (50%), improved customer experience (52%), faster product launches (50%) and lower running and maintenance costs (42%). For exchange houses and financing companies, 65% expect easier management and 59% specifically expect faster product launches. Among fintechs and exchange houses, which report the highest rates of missed opportunities and vendor dependency, modernization commitment reaches 93%. This suggests that institutions facing the sharpest competitive pressures are the most willing to pursue substantial infrastructure change.

Unification consolidates complexity into single platforms giving product control back to enterprises and replaces fragmented legacy systems with integrated infrastructure to prioritise innovation.

Operating globally, Stitch’s clients include MENA regional leaders such as Lulu Exchange, Alamoudi Exchange, Foodics, Yanal, Raya Financing and Tanmeya Capital, which are already leveraging unified infrastructure to accelerate product launches and reduce operational complexity across the region. Stitch enables global financial institutions to launch products in under 90 days, an 80% reduction in implementation time compared to industry norms.