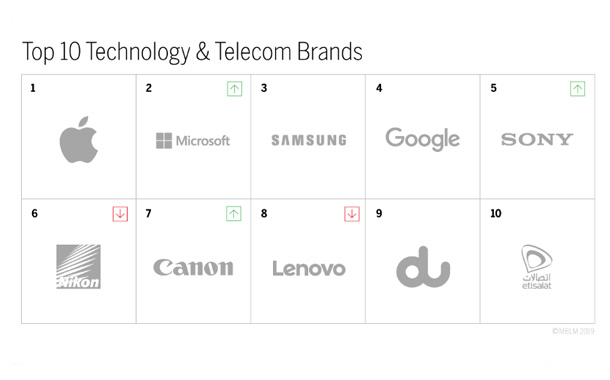

The technology & telecom industry in UAE has maintained its rank as #2 among 15 industries researched for the third year in a row in MBLM’s Brand Intimacy 2019 Study. Microsoft has demonstrated the strongest growth in the industry, rising to #2 this year from #5 in 2018 and #8 in 2017. Meanwhile, despite a decrease in its overall Brand Intimacy Quotient (BIQ), Apple still ranks #1 in the industry and overall in the Brand Intimacy Study.

Brand Intimacy is defined as the emotional science that measures the bonds we form with the brands we use and love. Top intimate brands outperform top brands in the S&P and Fortune 500 indices for revenue and profit. Consumers are also more willing to pay price premiums for intimate brands and less willing to live without them, according to the Brand Intimacy 2019 Study.

“Technology & telecom is a critical industry for the UAE’s competitiveness and efficacy. The feeling of enhancement through technology is palpable around us, and this industry is a natural vehicle,” said William Shintani, Managing Partner at MBLM. “Microsoft has successfully entered the cloud-based services arena and revitalized its brand to deliver key innovative services, repositioning themselves in the hearts and minds of their consumers.”

Other notable findings in the technology & telecom industry include:

-

- Technology & telecom ranks #1 among all industries for having brands consumers can’t live without.

- 41 percent of users surveyed are in some form of intimate relationship with a technology & telecom brand.

- The top three Most Intimate Brands for men in the entire study are all from the technology & telecom industry: Apple, Microsoft and Google.

- Apple is the Most Intimate Brand for millennials (18-34 year-olds), while Lenovo ranks #2.

- Microsoft is the Most Intimate Brand for 35-64 year-olds.

Methodology: During 2018, MBLM with Praxis Research Partners conducted an online quantitative survey among 6,200 consumers in the U.S. (3,000), Mexico (2,000), and the United Arab Emirates (1,200). Participants were respondents who were screened for age (18 to 64 years of age) and annual household income ($35,000 or more) in the U.S. and socioeconomic levels in Mexico and the UAE (A, B, and C socioeconomic levels). Quotas were established to ensure that the sample mirrored census data for age, gender, income/socioeconomic level, and region. The survey was designed primarily to understand the extent to which consumers have relationships with brands and the strength of those relationships from fairly detached to highly intimate. It is important to note that this research provides more than a mere ranking of brand performance and was specifically designed to provide prescriptive guidance to marketers. We modeled data from over 6,200 interviews and approximately 56,000 brand evaluations to quantify the mechanisms that drive intimacy. Through factor analysis, structural equation modeling, and other sophisticated analytic techniques, the research allows marketers to better understand which levers need to be pulled to build intimacy between their brand and consumers. Thus, marketers will understand not only where their brand falls in the hierarchy of performance but also how to strengthen performance in the future.