The overall global technology industry

We live in exciting times for the IT industry There is a huge and sustained interest in digital transformation across the globe; large companies, especially, are aware that they must invest in this area if they are to be competitive in the future. We are seeing the emergence of new technologies with exponential growth opportunities such as IoT, security, networking, and blockchain. The chip manufacturer Arm forecasts that by 2035 there will be one trillion connected computers, and Bain Capital estimates that spending on IoT will grow to $520bn by 2021. This is an industry which, like the seafaring explorers of the fifteenth and sixteenth centuries, is about to open up vast new horizons of expansion.

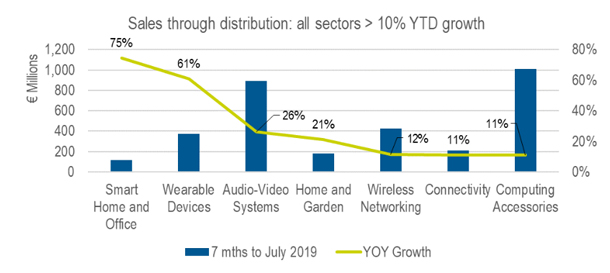

CONTEXT tracks the growth in sales of IT categories in the channel. We see that the enablers for Industry 4.0, and digital transformation drive the product categories with the highest growth. For example, hyperconverged systems are up 59% YOY. As part of the IoT sector, smart home and office products have continued their expansion with 75% YoY growth.

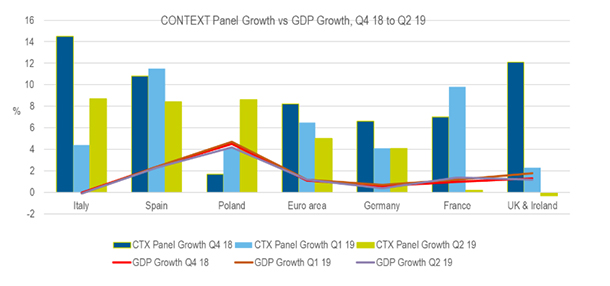

In our panel, we see that IT consistently outperforms GDP growth, though it has slowed in the last three quarters – in Q4 2018 it was higher by 7.1% on average, in Q1 2019 4.2% and in Q2 3.4%. In two countries – UK and France – panel growth was below GDP in Q2 2019.

There is no shortage of investment capital for traditional IT and for a plethora of start-ups all over the world. Big investment announcements remind us of the vibrancy of the technology industry. In April, Samsung Electronics announced “Semiconductor Vision 2030”: an investment in the system semiconductor industry of $114 billion by 2030. It aims to retake a lead in the semiconductor industry against other manufacturers such as Intel and Texas Instruments. After suffering product shortages from September 2018 due to unforecast demand, in January Intel announced its intention to spend $11 billion on a new manufacturing facility in Israel.

One of the major uncertainties in investment is the disruption caused by the China-US trade war. This has impacted, for example, the future of Huawei’s business in the US, Europe, and other countries dependent on US influence and power. Recent events with Huawei looking to sell off its 5G business gives hope that compromise solutions will be found.

Lastly, we are living in the period of 5G launches and May/June 2019 were remarkable months for this:

- Deployment in South Korea has moved at great speed since the official launch of its 5G network on 3 April. According to the Yonhap news agency, the country reached the milestone of one million 5G subscribers in June 2019. Korea Telecom VP Lee Pil-jae has said that he expects more than three million South Korean mobile customers to switch to 5G by end of 2019.

- On 30 May 2019, EE (a mobile network owned by BT) launched 5G services in six cities in the UK. At the same time Vodafone launched commercial 5G services in two countries, Italy and Spain. They are deploying equipment from Nokia and Huawei in five Italian cities. The launch of its commercial network in 15 Spanish cities was scheduled for 15 June.

- In the same week, Etisalat launched 5G service and smartphones in UAE. The initial effect will be to enhance mobile broadband and 5G wireless and it will also impact government smart-city initiatives.

No-one expects the roll-out of 5G to be fast or easy – the technology is such that significantly more masts will need to be erected to ensure the coverage. But this will be a game changer in terms of the speed of upload and download of data and will reinforce in coming years the development of the IT industry.

Market intelligence report and key performance indicators of the respective verticals

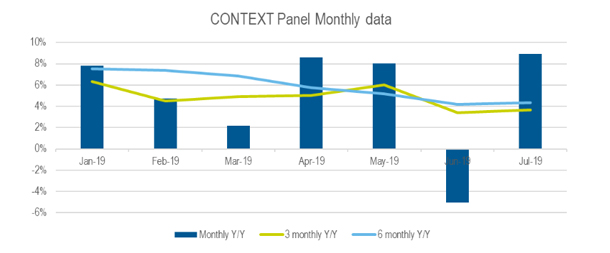

The year is progressing well with sustained growth, though the six-monthly trend analysis is showing a decline in the rate of growth from 7.5% in January to 4.3% in July. A decline in June which was concerning was made up for in July, and we are waiting to see how Q3 turns out.

Panel includes: UKI, Germany, Italy, France, Spain, Merged countries, Poland, Switzerland, Sweden, Austria, Belgium, Czech Republic, Denmark, Portugal, Finland, Norway, Baltics, Slovakia, Russia, Turkey, Brazil & Argentina

Consumer technology – highs and lows

The tech industry is in two parts – consumer and B2B, and we cover both in this overview. It is important, even if your focus is on B2B, to keep an eye on the consumer tech industry.

- In the 7 months to 31st July 2019, the top four growth areas (growing at above 10% year-on-year) in the CONTEXT panel (covering all Europe, Russia and Turkey) were all consumer (with wireless networking, connectivity and computing accessories a mix)

- These areas start from a low base, therefore it is easier to grow in % terms. In relative size, the core areas of mobility, printing, servers, software, displays and other hardware dwarf the fast-growing areas. Nevertheless, these growth areas are vital to monitor closely, as in the categories and products are contained the future of the technology industry.

- Keeping an eye of the consumer industry is important for other reasons

- Crossover of technology from consumer to business – so, for example, smart home growth is being powered by consumers purchasing voice control devices such as Google Home and Amazon Echo, while at the same time B2B applications for these devices are also being invented

- There is a blur between consumer and B2B products with “Bring your own device”, though this trend has been impacted by the increased awareness of the needs of corporate IT security

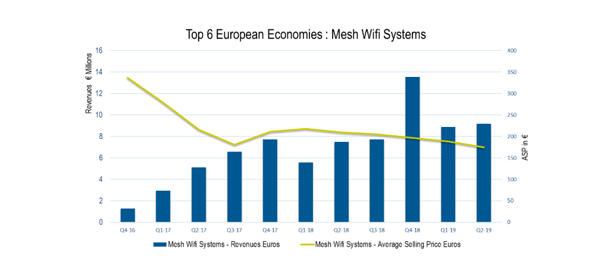

- Expertise in areas such as networking are crossing over from B2B to consumer. So for example the supply demand curve of wi-fi mesh systems shows how consumers are now adopting the new technology

On the other hand, other areas of consumer technology are faring less well, with long-term decline in the number of PC’s being sold, downward pressure on consumables and even smartphones reaching a plateau in 2017.

All eyes on B2B technology

The sky’s the limit for B2B. We are at an inflection point where growth in the use of IT to effect business change is lifting off with digital transformation, where CIO’s are becoming critical business partners instead of functional providers of technology.

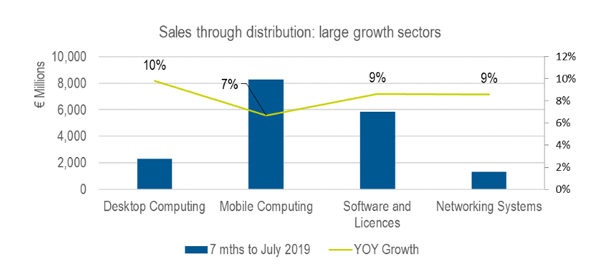

As an illustration of factors driving healthy growth in the IT industry, here are 4 fast growing sectors

- Desktop computing is being driven by the Windows 10 refresh cycle and has been a powerful engine of growth in the SMB channel (growing 12.1% in Q2 2019)

- Mobile computing has seen big increases in the commercial sector, also driven by the Windows 10 refresh cycle. In July, for example, commercial notebooks were up 11% year-on-year

- Software and licences have grown fast through the corporate reseller channel, driven by IBM (+20.2%) and Microsoft (+7.3%). Investment in all forms of security and networking are strong

- Networking and storage are increasing as new tech such as Hyper-Converged infrastructure comes into play, one of the exciting new technologies underpinning improvements in efficiency in datacentre management.

Case-study Turkey

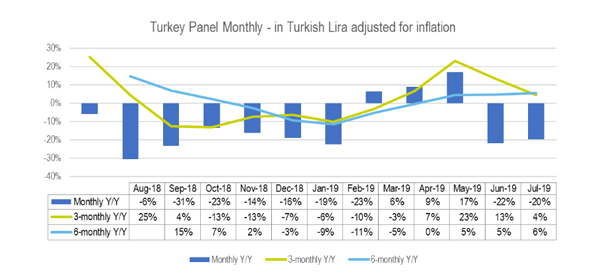

There is significant trade between the Middle East and Turkey, and it is complicated to follow what is happening in the IT industry in Turkey because of three factors – 1) a high rate of inflation which has nevertheless been reducing for the last 6 months 2) large fluctuations in the exchange rate 3) lack of clear data.

The CONTEXT panel counters all three uncertainties as it is denominated in Turkish lira and/or euros and dollars, is reliable in covering over 80% of the wholesale distribution market in Turkey, and the data can be adjusted for inflation. It is, therefore, an invaluable reference point for what is happening there. The below tracker shows with inflation adjusted numbers the history of the recent crisis in Turkey. 8th August 2018 marked the end of an IT boom when the currency lost 10% of its value in one day. The 3-monthly trend went from 25% YOY growth in August to -13% in October 2018 after a disastrous month in September. The situation has been improving steadily since March with inflation going down and growth returning, through the last two months have shown a downward trend. This information is available by product category, vendor, and channel, and includes the volumes and average selling prices.

Forecast for the remainder of 2019

At the start of the year, we forecast growth in the IT Channel to be between 3 to 6% for 2019. We maintain this forecast: growth has been 4.9% year-to-date to the end of July. The major external factors which are causing uncertainty in the CONTEXT panel are:

- The impact of Brexit

- Slowdown in growth in Germany

- Impact of Chinese/American tariffs on world trade