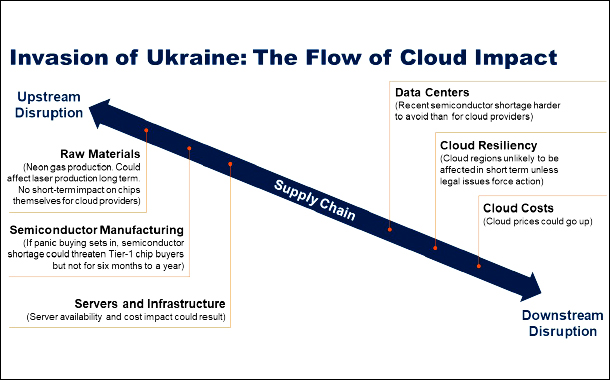

The invasion in Eastern Europe is a humanitarian catastrophe. The catastrophe is leading to significant uncertainty for businesses and government agencies worldwide. Gartner is taking the assumption that we will live in a multipolar world, in contrast to a globalised world. The invasion is a further step in this direction.

Cloud customers will double down on what they already have. If they are cloud, they will stay there. If they are not cloud, they will stay there. Those on the fence will be forced to choose. Sovereignty fears may cause customers to shy away from US- based cloud deals, especially in the Russian sphere of influence.

De-platforming of Russia may slow cloud growth nearly 30% CAGR in 2022 and over $2.0 billion in revenue for Russia of dominant cloud providers, Google, Amazon and Microsoft, and increase use of Russian providers such as Yandex and mail.ru.

Cyberattacks could chase customers away from cloud as the fear of attacks on concentrated computing resources grows. Cloud security practices illustrate how effective cloud service providers are at detection and response at scale.

Sustainable energy efforts will blunt the impact of energy cost increases brought about by the invasion of Ukraine. Hydraulic power, solar and other mechanisms will be used for cloud region construction. Upstream disruption and fears drive power costs up by multiple factors.

Semiconductor and supply chain disruption will reduce availability of semiconductors for data centers and cloud regions and, in turn, increase cost of cloud infrastructure. For example, 70% of upstream neon gas production for semiconductor manufacturing is produced in Ukraine.

Tier-1 buyers, example cloud providers will get priority in ordering chips and, unless panic buying sets in, they have enough supply for the next six months to a year. Shortages have been demand-driven. This will continue. However, extended length uncertainties may change this.

Advice for end-users

- Public cloud will be impacted but likely not as acutely as traditional data center services.

- Accelerate the shift to using cloud services as a supplement to data center services as the downstream impact of upstream disruption becomes clearer.

- Consider multiple cloud service providers.

- Create a budget reserve for new cloud requirements to cover any cloud cost overruns and ensue that cloud terms and conditions cover inflation of cloud costs.

- Double down on virtualisation and Kubernetes adoption as a means of hedging against price increases or any long-term infrastructure or ecosystem impact.

- Demand clear cloud cybersecurity roadmaps and statements of liability as a hedge against resultant cyberattacks against consolidated infrastructure.

- Review budgets for energy usage, inflation on general products, services, supply chain disruption and other ancillary impacts that will affect use of cloud investments as planned.

- Demand statements of expected impact from cloud providers as input to potential contract negotiation. Like with COVID-19, customers have a right to know what the cloud providers believe will happen.

Recommendations for hyper scalers

- Evaluate ramifications and contract obligations of current and potential future sanctions. Are terms and conditions robust enough?

- Clarify the direct and indirect impact to customers of sanctions that can potentially force de-platforming of an entire country.

- Clarify how billing ongoing and retroactive is handled for sanctioned customers who are cut off or limited in access.

- Reinforce how to deliver security, backbone and DDOS in the cloud ecosystem.

- Go to market that the ecosystem is less vulnerable.

- Avoid any carry-on effect to the invasion that may impact non-NATO countries nearby that have a cloud region.

- Plan for negative perceptions that the Ukraine invasion may cast for possible similar actions elsewhere, such as an invasion of Taiwan.

Recommendations for SaaS, PaaS, ISVs

- Embrace multiple cloud providers as a hedge against regional disruption.

- Identify customers at risk of being de-platformed, as well as applications designed or supported by developers in the Ukraine or Russia.

- Simplify exit-strategy planning from directly impacted cloud regions or providers.

- Evaluate legal terms and conditions applying to customers potentially de-platformed in response to government mandates or mandates to underlying hyperscale cloud providers and data centers.

- Clarify legal obligations to enforce de-platforming mandated on customers.

- Evaluate ramifications continuously throughout the invasion and resultant mandates, sanctions, or other activities.

- Evaluate how fast you can respond to sanction demands or to restore customer access.

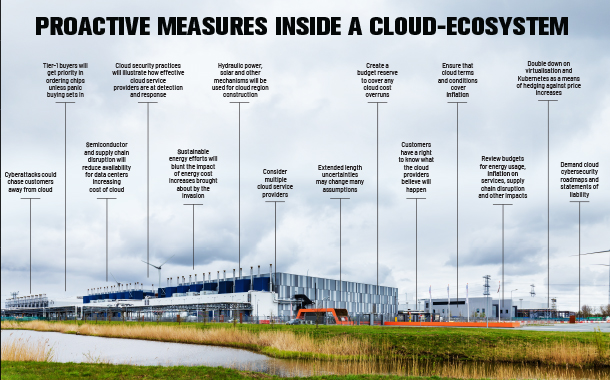

Proactive measures inside a cloud-ecosystem

- Cyberattacks could chase customers away from cloud

- Cloud security practices will illustrate how effective cloud service providers are at detection and response

- Sustainable energy efforts will blunt the impact of energy cost increases brought about by the invasion

- Hydraulic power, solar and other mechanisms will be used for cloud region construction

- Semiconductor and supply chain disruption will reduce availability for data centers increasing cost of cloud

- Tier-1 buyers will get priority in ordering chips unless panic buying sets in

- Extended length uncertainties may change many assumptions

- Consider multiple cloud service providers

- Create a budget reserve to cover any cloud cost overruns

- Ensure that cloud terms and conditions cover inflation

- Double down on virtualisation and Kubernetes as a means of hedging against price increases

- Demand cloud cybersecurity roadmaps and statements of liability

- Review budgets for energy usage, inflation on services, supply chain disruption and other impacts

- Customers have a right to know what the cloud providers believe will happen

Excerpted and adapted from the Gartner report: Potential Impact on Cloud Service Providers Due to Russia’s Invasion of Ukraine, by Sid Nag and Daryl Plummer.