While the Gulf region is undergoing steady recovery, the past few years of turmoil have forced executives to inspect every aspect of their operations. Supply-chain issues, despite some encouraging improvements, continue to cast a shadow in some industries. Inflation rates are creeping ever upwards.

In the UK, improvement is expected around mid-2023, whereas in some quarters in the US, inflation is feared to be a longer-term problem. While in Gulf countries the highest inflation rates are around half those in the US and Europe, we expect all these factors and more to keep regional business leaders on their toes in 2023.

Energy costs will be of significant concern and the entire C-suite will start to take an interest in economics as external issues continue to impact budgets and operations. From supply chains to the choice of Opex over Capex, the year ahead will encompass change driven by the lessons of the recent past.

Energy costs will be of significant concern

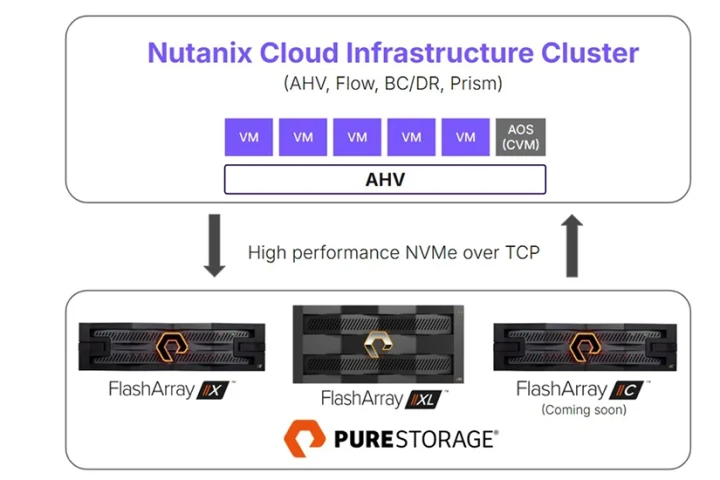

While historically large enterprises have worked with different cloud providers for different use cases, this creates cloud lock-in which customers are sick and tired of. Next year we will see an increase in customers building cloud neutrality into their design to avoid this lock-in even if it’s only to prepare for the future.

To do so, companies will rely heavily on containerising applications, making them portable across private, public and hybrid cloud infrastructure, regardless of the cloud providers at play. There will also be a push to consolidate management of applications through Kubernetes platforms with all the flexibility, speed, cost effectiveness and security needed to ensure success in a cloud neutral environment.

Realistically, the CFO will dictate the agenda over the next twelve months, and likely beyond. C-suite officers rarely take their eye off the bottom line, but next year will see them staring at it more intently, which obviously means the CFO will steer budgets even more than usual. In the technology sector, we will hear plenty more conversations about TCO and in-year ROI. And, given the spend control that they offer, I think that means a more concerted move towards subscription services for many organisations.

C-suite will start to take an interest in economics as external issues continue to impact budgets and operations

Many finance teams favour a general Capex-before-Opex approach. Writing off depreciation for physical assets like IT hardware is a helpful mechanism for improving the health of corporate books, after all—especially for cash-rich companies.

But unpredictable energy and infrastructure costs mean fixed-cost subscriptions look very appealing, especially when coupled with the fact that new services can be brought on without massive initial investments. And those subscription services that can deliver savings, not just in year one but well into year two and beyond, could sway CFOs and budget holders in 2023.

With sustainability being a priority for many organisations, efficient technologies which use less energy and have a better carbon footprint will be on many board’s agenda. Today’s businesses are much more environmentally conscious, but volatile energy costs have forced the issue in many countries around the world and in the next year we will see green and sustainability credentials at the tip of the spear in conversations between vendors, service providers and customers.

Many groups within organisations will develop a much greater understanding of sustainability metrics and methodologies and will start applying them when making technology choices.