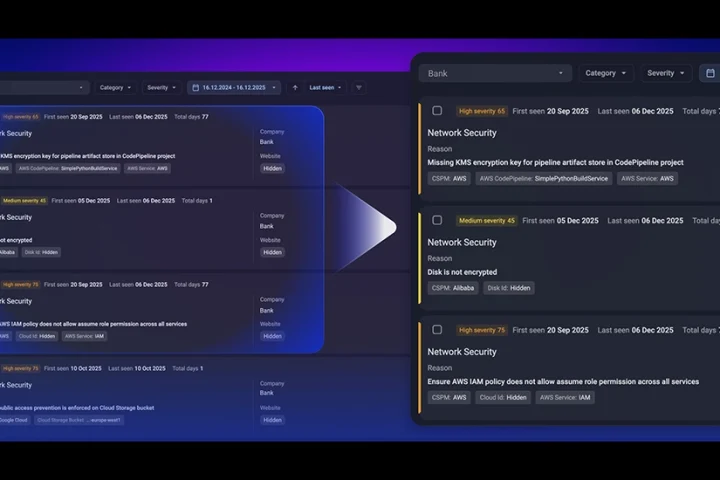

Misys released FusionBanking Essence, its retail banking solution, to enable banks to deliver a simpler, faster and smarter banking experience to consumers and SMEs.

Streamlined digital onboarding capabilities ensure rapid account opening, while advanced technologies such as secure fingerprint authentication enable high quality customer service and security. Advanced analytics enable banks to meet customer needs more effectively, coupled with interactive financial planning tools which help customers better manage and plan their finances. Features such as multi-currency accounts, facial and ID recognition during onboarding further address the needs of a tech-savvy globalised world.

“We are seeing the emergence of two-speed banking – a world in which forward thinking banks are embracing digitalisation and analytics to put customer needs first,” said Simon Paris, President at Misys. “These fast-lane banks are in the market for modern front-to-back digital banking solutions to meet the needs of the increasingly mobile and tech-savvy customers, who demand highly personalised and relevant experiences.”

Building on the Misys “outside-in” banking philosophy, the enhancements are designed to help banks meet the expectations from consumers and SMEs for fast, relevant and convenient digital banking.

Stephen Greer, Analyst at Celent, said: “The new normal of financial services necessitates a broader understanding of what it means to be digital. Banks must be able to meet the demands of today’s tech-savvy consumers and SMEs, pushing customer experience levels to new highs whilst still meeting regulator demands and driving down costs.”