Chipmaking powerhouse Nvidia etched its name in history on Wednesday, becoming the first publicly traded company to reach a market capitalization exceeding $4 trillion, underscoring the extraordinary investor enthusiasm fueling the artificial intelligence revolution.

Although Nvidia’s valuation eventually slipped below the landmark figure by the end of the trading session—closing at $162.88 per share—the achievement reflects the scale of transformation driven by AI technologies, widely regarded as the most profound disruption in the sector since Apple’s introduction of the iPhone 18 years ago.

The milestone also highlights a dramatic changing of the guard: Nvidia is now worth nearly $900 billion more than Apple, which once led market valuations as the first firm to cross the $1 trillion, $2 trillion, and $3 trillion thresholds thanks to its iconic smartphone. While Nvidia races to meet the surging demand for its advanced processors that power AI data centers, Apple has struggled to fulfill promises of weaving cutting-edge AI into its products. After more than a year of delays in upgrading its Siri virtual assistant, Apple recently acknowledged that realizing its AI ambitions will likely take until 2026—prompting speculation it may need to acquire a specialized AI start-up to regain momentum.

Meanwhile, former Apple design chief Jony Ive has joined forces with OpenAI to develop a next-generation wearable AI device that could eventually challenge the iPhone’s dominance.

Across the tech landscape, other industry giants are escalating their AI investments at a historic scale. Microsoft, Amazon, Alphabet (Google’s parent), and Meta Platforms (Facebook’s parent company) have earmarked a combined $325 billion this year alone to accelerate their AI capabilities—a significant portion of which is expected to funnel into Nvidia’s ecosystem.

Nvidia’s stock has surged more than tenfold since early 2023, vaulting from a market value of roughly $400 billion to this week’s record highs. Even after dipping back under the $4 trillion mark, confidence in the company’s growth remains strong. CFRA analyst Angelo Zino issued a bullish forecast on Wednesday, projecting the stock will climb to $196 within the next 12 months, potentially pushing Nvidia’s valuation toward $4.8 trillion.

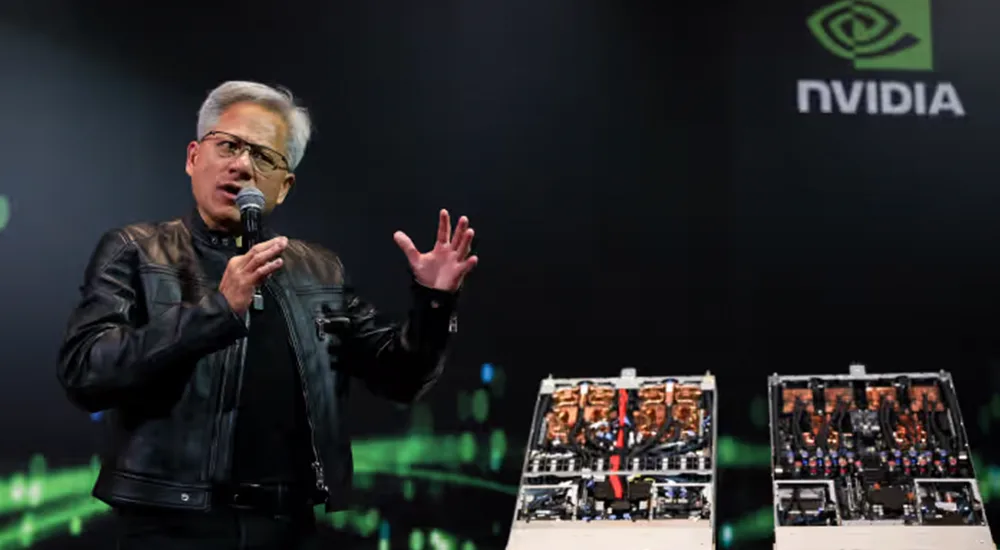

The company’s meteoric rise has also catapulted CEO Jensen Huang to near-mythic status among investors and technologists alike, earning him the nickname “the godfather of AI.” Huang’s personal fortune has swelled to an estimated $142 billion as Nvidia’s influence has expanded.

According to Josh Gilbert, Market Analyst at eToro, NVIDIA’s meteoric rise highlights the sheer momentum of this AI boom, which isn’t showing any signs of slowing down. NVIDIA has become the heartbeat of the market, making up around 7.5% of the S&P 500 and nearly 10% of the Nasdaq 100. In the same way Apple symbolised the smartphone era, NVIDIA now defines the AI era. Its last earnings in May solidified its position with continued growth, margins most businesses would envy, and a war chest that gives the company the firepower to keep innovating.

In the same breath, overnight, bitcoin surged past USD$112,000 for the first time, setting a fresh record. Strong ETF inflows and a solid macro backdrop have helped drive market momentum, but perhaps the most crucial shift is who’s buying. Institutional adoption is growing, and this is the first real bull market where institutional participation is front and centre.

Earlier this year, it briefly appeared Nvidia might lose momentum when President Donald Trump announced sweeping tariffs, sparking a broad market sell-off that pulled Nvidia shares below $87 at their lowest point. However, the stock quickly rebounded, underscoring investor conviction that AI will remain the defining engine of growth for years to come.

With the appetite for AI accelerating across industries, most analysts agree that Nvidia’s position at the heart of this transformation makes further records likely in the near future.