It has taken 30 years since the term was coined in 1992, but big money has now moved into the Metaverse—accompanied by big hype. To understand the pull of the Metaverse, it helps to think in terms of the distinct trends that are converging to create it.

Recall the release in 2007 of the original iPhone—a single device that brought together a camera, computer, mobile phone, and operating system. The technologies involved were not new; the revolution lay in their convergence and the resulting entrepreneurial stimulation.

In similar fashion, the Metaverse is about the convergence of several developments, all of which involve step changes in technological capability:

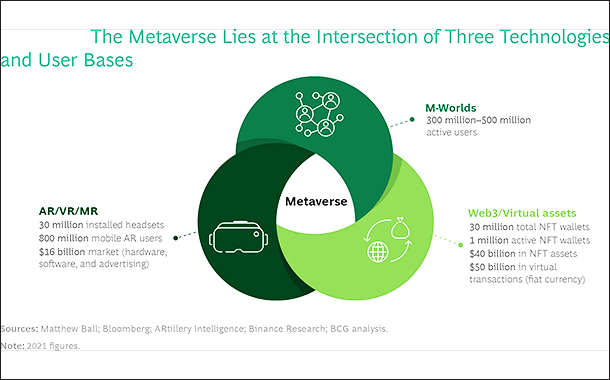

- #1 Metaverse worlds or m-worlds are gathering hundreds of millions of active users thanks to computing capacity and mass-market availability of mobile phones, tablets, and PCs, as well as improvements in cloud services and connectivity such as fibre and 5G.

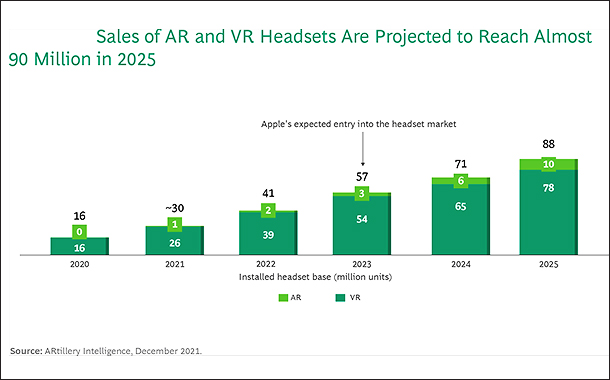

- #2 A mass market for augmented, virtual, and mixed-reality headsets is growing fast, with devices.

- #3 Virtual assets powered by an innovative Web3 technology stack are rising in popularity as objects to acquire and exchange.

Remember out of the ashes of the dot com meltdown rose a global e-commerce market worth almost $5 trillion in 2021. While any predictions of what the future holds will almost certainly be off-base, forward-looking companies may want to experiment with the new technologies and possibly invest in young Metaverse players or emerging technologies in order to assess the potential of extended reality for their products, services, and operations.

If you replace Metaverse with cyberspace, the meaning of the sentence will not change in 90% of cases. Enthusiasts see the Metaverse as the next generation of the Internet, a virtual, interconnected reality seamlessly woven into our physical world. Gamers are already familiar with this notion—albeit usually in two dimensions—but games are only the beginning.

In 2021, more than $40 billion was spent on nonfungible tokens NFTs—certificates of ownership of digital assets. Goldman Sachs predicts as much as an $8 trillion opportunity on the revenue and monetisation side of the Metaverse. Morgan Stanley likewise sees an $8 trillion Metaverse market—in China alone.

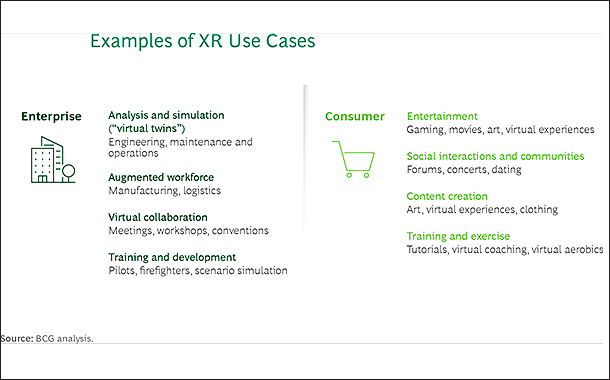

Much of the value of the Metaverse may ultimately lie not in consumer but in business applications, such as virtual meetings and training sessions, new-product design capabilities, or the ability to give customers the experience of a virtual home or vehicle before buying a real one.

Divergent views are hardly unusual when new technologies and models of business, finance, and commerce are rapidly taking shape and pushing against existing paradigms.

Building M-worlds

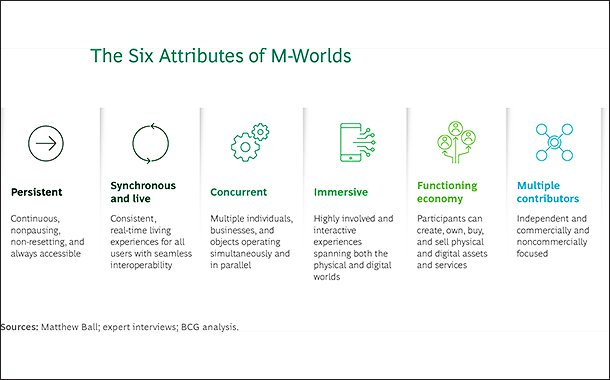

M-worlds are immersive applications that offer brands the possibility of reaching new audiences notably, Gen Z users in different ways. Able to run on mobile phones, tablets, PC browsers, and AR or VR headsets, they have multiple distinctive attributes. Each m-world is built to host its own virtual communities and content, and each has its own business model, rules, and user accounts.

Many m-worlds began as gaming applications, but they have since added features and attractions. M-worlds pursue multiple monetisation models as they seek to build their virtual-asset economies. These include both traditional approaches, such as subscription, advertising, and in-app purchase models, and newer, Metaverse-specific methodologies, including initial asset offerings, Metaverse agencies, and advertising using Metaverse-generated data.

The m-world landscape is evolving quickly with the arrival of major new platforms that will offer a better hybrid, two dimensional plus AR VR, experience.

Extended reality

Technological advances in AR, VR, and MR often referred to collectively as extended reality, or XR are facilitating the shift from 2D to 3D by providing more realistic experiences and digital displays that are better synchronised with head movements. Indeed, surveys have found that the two biggest barriers to wider adoption of XR are the user experience and limited content, both of which are improving fast. Equipment costs also have fallen, and sales are projected to increase quickly.

When you get to 10 million units active, that is kind of a magic number. At that point, you have a self-sustaining ecosystem. At its current pace, Meta could reach this critical mass by mid-2022. And Apple’s expected entry in early 2023 could turn out to be the iPhone moment for AR and VR.

While the number of AR and VR users climbs, mobile AR, which leverages smartphone cameras and processing power to superimpose information on what the phone is seeing, helps bridge the transition. More than half of the 6 billion smartphones in use today are sufficiently powerful to enable mobile AR.

In addition, the software development kits from Apple for iOS, and from Google for Android, can be extended to AR and VR development. According to research from ARtillery Intelligence, 800 million users actively use mobile AR, a number that it projects will grow to 1.7 billion in 2025.

The use cases for AR, VR, and MR span consumer and business applications. The top five sectors for immersive environments are health care, education, workforce development, manufacturing, and automotive. The most likely areas for business applications were employee training and workflow management.

Disrupting the automobile industry

In the automotive industry, AR and VR are being used across the value chain from product and process engineering to sales and after-sales support and service. OEMs and their major suppliers are adopting the technology in engineering and operator training to create virtual showrooms and test drive experiences, and to provide virtual repair guides and simulations of upgrades.

OEMs, especially in the luxury vehicle segment, are using m-worlds and Web3 technology to build immersive brand experiences and virtual assets tied to their real-world products. Alpine, the race car subsidiary of Renault, is releasing a virtual hypercar in five exclusive liveries using NFTs for proof of ownership.

Boeing has announced that it will use VR at scale to engineer its next aircraft, powering an immersive digital twin of the product.

Internet 3.0 or Web 3.0

In the initial iteration of the Internet Web 1.0, users read or otherwise consumed digital content that publishers or others created. Web 2.0 allowed users to both create and consume content, but centralised networks continued to control and make money from its distribution.

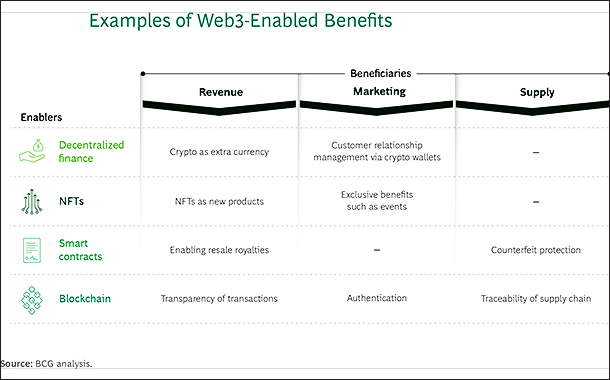

In the emerging Web3 iteration, users consume, create, and own content; the networks and the money exchanged are decentralised, with blockchain technology replacing centralised intermediaries and providing the trust that enables both consumption and exchange.

Web3 is still at an early stage but is already powering a vibrant virtual-asset economy that includes cryptocurrencies, NFTs, and smart contracts.

More than $50 billion in virtual goods were purchased in 2021 using traditional mobile or credit card processing on web-based applications or on app platforms. There are some 30 million NFT wallets, including 1 million active wallets, which spent some $40 billion on NFT purchases in 2021.

Go to market for channel partners

Channel partners can start by familiarising their organisations with the potential impact of the Metaverse. A useful vehicle is an assessment of how the business may be positively or negatively affected by the convergence of the three trends:

- Rise of m-worlds

- Improvements in AR, VR, MR

- Expanding use of Web3 assets enabled by blockchain

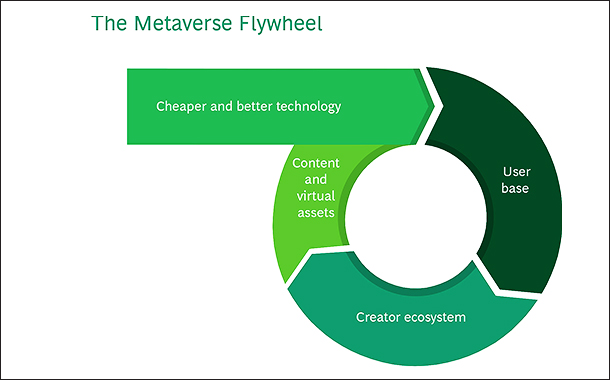

Channel partners can choose areas of focus on the Metaverse flywheel and potential use cases for their efforts. They can decide to participate in the following:

- Part of building new infrastructure

- Monetise content and virtual assets

- Create B2B or B2C content

- Create inward-facing experiences such as customer showrooms, virtual conferences, remote collaboration solutions

- Build relevant audiences, both from existing and prospective areas of interest.

As they move into the Metaverse world, channel partners should also attempt to experience it.

Here are some recommendations:

- Buy headsets and organise demo sessions to gain internal traction.

- Bring together experienced and passionate people in teams that meet regularly.

- Collect use cases and create formats for brainstorming and capturing potential sources of value.

- Invest in prototypes.

- Hire talent, including those with XR interest and experience in relevant Metaverse fields.

- Make your interest public. Communicate externally that the Metaverse is on your radar and share what you are doing.

- Build partnerships. The Metaverse will be an ecosystem, and there is longer-term value in starting to build connections now.

At the end of 2021, approximately $90 billion in virtual and physical money was circulating on m-worlds, and this number is growing steadily, indicating the rising economic popularity of the Metaverse.

Key takeaways

- Remember out of the ashes of the dot-com meltdown rose a global e-commerce market worth almost $5 trillion in 2021.

- If you replace Metaverse with cyberspace, the meaning of the sentence will not change in 90% of cases.

- Enthusiasts see Metaverse as the next generation of the Internet, a virtual, interconnected reality woven into the physical world.

- Gamers are familiar with this notion—albeit usually in two dimensions—but games are only the beginning.

- Mobile AR, which leverages smartphone cameras and processing power to superimpose information helps bridge the transition.

- More than half of 6 billion smartphones in use today are sufficiently powerful to enable mobile AR.

- According to ARtillery Intelligence, 800 million users actively use mobile AR, a number it projects will grow to 1.7 billion in 2025.

- The use cases for AR, VR, MR span consumer and business applications.

- M-worlds are immersive applications that offer brands possibility of reaching new audiences notably.

- When you get to 10 million VR units active, that is kind of a magic number. At that point, you have a self-sustaining ecosystem.

- At its current pace, Meta could reach critical mass by mid-2022.

- Apple’s expected entry in early 2023 could turn out to be the iPhone moment for AR and VR.

- OEMs in the luxury vehicle segment, are using m-worlds and Web3 technology to build immersive brand experiences.

- Alpine, the race car subsidiary of Renault, is releasing a virtual hypercar in five exclusive liveries using NFTs for proof of ownership.

- Boeing has announced that it will use VR at scale to engineer its next aircraft.

- There are some 30 million NFT wallets, including 1 million active wallets, which spent some $40 billion on NFT purchases in 2021.

Channel partners supporting B2C models can look at:

- New ways to shop, such as virtual storefronts, virtual try-ons for virtual and physical products.

- Physical-virtual experiences for a brand’s events or concerts.

- Co-creating assets and experiences, exchanging goods, earning money.

- Innovative ways to grow a community around interests or exclusivity.

Excerpted and adapted from: The Corporate Hitchhiker’s Guide to the Metaverse, published in April 2022 by Jean-François Bobier, Tibor Merey, Stephen Robnett, Michael Grebe, Jimmy Feng, Benjamin Rehberg, Kristi Woolsey, Joel Hazan, all from by Boston Consulting Group.